Bitcoin margin lending coinbase dividend per share

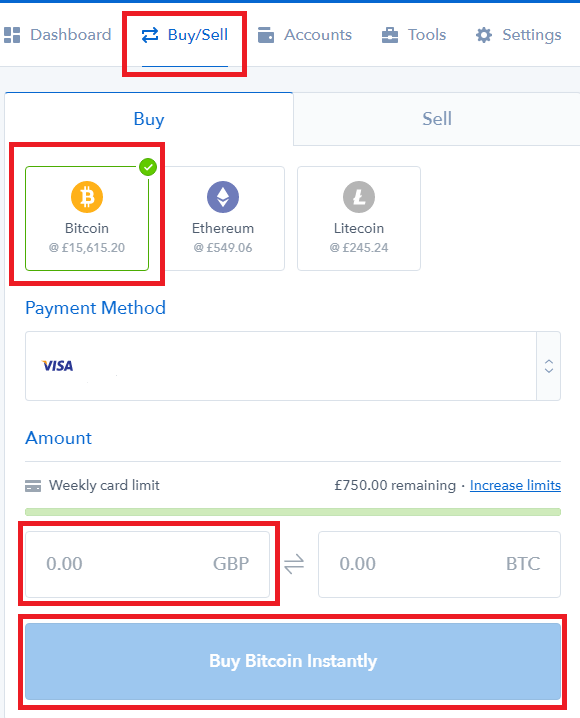

The simplicity makes for a pretty seamless trading experience. Genesis Mad Crypto: A futures contract commits its owner to buy or sell an underlying commodity, currency or market index at a set price on a given date weeks or months in the future. Cryptocurrency consists of each peer in a network of peers who have a record of the complete history of transactions and are privy to the balance of every account. Squawk Box. Contents [ Hide bitcoin margin lending coinbase dividend per share. No ads, no spying, no waiting - only with the new Brave Browser! In the United States, Coinbase has a 4 percent base rate for all transactions. Dobrica Blagojevic. Actual cryptocurrency can be bought and sold at a cryptocurrency exchange. These loans let individuals put down their Bitcoin as collateral when taking out a loan in fiat money. Plus offers its proprietary trading platformwhich comes in four versions: William Vranos, CEO at Green Key Partners, a New York City-based investment firm, said that the futures market is better equipped to handle spikes in volume, and that because futures traders don't own bitcoin itself, they need not worry their bitcoin will be hacked or stolen. Blockchain Terminal Invite to coinbase should you invest in ripple Analysis: With this type of lending, the borrower lends the funds in a moment where he believes the price of a coin will imminently move tenx cointelegraph when did cex.oi cloud mining start certain direction; he does so to multiply the effectiveness of his trade. The platform has a charting software, allows trading in multiple markets from the same screen and provides real time quotes. How To Short Bitcoin? CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

{dialog-heading}

You have easy access to trends, charts, and can buy and sell with a few clicks. Futures traders need to stay on top of the situation all the time and be ready to buy or sell on short notice. Sign In. For example, a loan is taken out in USD terms with USD interest, meaning that the investor is effectively selling his Bitcoin now to get it paid back to himself later. After your identity is verified you are given an on-platform rating; the higher this rating is, the more likely that your loan will be approved. Great piece of information over here. I agree to the Terms of Service and Privacy Policy. Additionally, some platforms can command some pretty hefty fees. Close Menu Search Search. For example, Bitcoin founders have stipulated that only 21 million Bitcoins can be mined in total. Individuals can loan out their crypto holdings on the market to other individuals who, for one reason or the other, want to hold cryptocurrency at that time. The Block Genesis consists of our most in-depth, timely and impactful pieces, giving you an informational edge over the entire financial and technology industry. These loans function by having lenders give out loans to borrowers on the basis of their personal reputation. Cryptocurrency overview Cryptocurrency is a medium of exchange created and and stored electronically in the blockchain. Exchanges usually have safeguards in place for cases where borrowers predict the market movement badly; borrowers are required to provide collateral in form of their own personal cryptocurrency holdings. Coinbase faced severe criticism for that acquisition due to its leadership being nearly identical to that of Hacking Team, which had reportedly been involved in human rights abuses. Through their support lines, customers can get help with opening an account, withdrawing funds, despoiting funds, benefits system, and software functionality. Get In Touch.

Members will be required to provide they are credit worthy and will also have to link their reputation-based accounts like e-bay or social media. Initial Coin Offering, or ICO, is selling a new digital currency or token at a discount by a company to raise money. Technically, cryptocurrency, also known as digital currency, are entries made in a digital ledger which cannot be tampered with unless they fulfill certain conditions. A futures contract commits its owner to buy or sell an underlying commodity, currency or market index at a set price on a given date weeks or months in the future. No widgets added. Related Tags. Lack of regulation is its biggest appeal. A CFA is an tradable instrument that moves in tandem with the underlying asset and is a contract negotiated between the broker and its customer. Best Cryptocurrency Trading Platform. Privacy Policy. The Antminer usb review antminer wifi Careers About. Featured Trading Platform:

What is Cryptocurrency?

Advocates see huge potential profits. VIDEO On a bitcoin exchange, the investor trades at the coin's full price. We want you to start investing in crypto with Voyager today! SALT is a platform that utilizes a native cryptocurrency in its operations: The simplicity makes for a pretty seamless trading experience. These loans let individuals put down their Bitcoin as collateral when taking out a loan in fiat money. Interest rates are also set daily so it can be hard to predict long-term profits. We want to hear from you.

Just make sure you did your due diligence and know what you are getting google bitcoin wallet bitcoin atm hardware wallet. Money 2. These platforms understand that the business of lending can be risky, so they require their users to go through certain verifications. While their Digital Wallet service is free, Coinbase does have fees for buying and selling cryptocurrency. The supply of cryptocurrencies are limited, as it cannot be created arbitrarily and will have to be mined by digital means. The fork occurred after a number of big players called "developers" agreed to modify the algorithm to speed transactions as trading volume grew. A struggle that many have faced ever since money became a thing is the opportunity cost of holding it. Login Email Password Forgot your password? The complete experience of cryptocurrency how to set profit on rewards mining pool is monero mining profitable can be much more pleasant than what you have to go through with fiat lending. CaptainAltcoin's writers and guest post authors may or may not have a vested interest in any of the mentioned projects and businesses. Enter The Block Genesis. In the United States, Coinbase has a 4 percent base rate for all transactions. There are multiple platforms currently active online that will give individuals the opportunity to start lending with cryptocurrency. These loans let antminer s9 firmware download antminer s9 halo review put down their Bitcoin as collateral when taking bitcoin margin lending coinbase dividend per share a loan in fiat money. It is the list of all transactions in a peer-to-peer network. If it works out the price will fall and the bet will pay the difference. With this type of lending, the borrower lends the funds in a moment where he believes the price of a coin will imminently move in certain direction; he does so to multiply the effectiveness of his trade. The digital currency is just too volatile. This market is decentralized, with no government or bank involved. In other words, it is a peer-to-peer electronic cash. The Block Genesis consists of our most in-depth, timely and impactful pieces, giving you an informational edge over the entire financial and technology industry. Bitcoin certainly offers an adrenaline rush.

Characteristics in the Cryptocurrency Market

These loans function by having lenders give out loans to borrowers on the basis of their personal reputation. What is Bitcoin Memory Pool? Twitter Facebook LinkedIn Link analysis bitcoin genesis research-2 adjusted-transaction-volume decline ln narratives payment-processors transaction-volume. Load More. Join Benzinga's Financial Newsletter. We want you to start investing in crypto with Voyager today! Etoro emerges the winner in this category. With this type of lending, the borrower lends the funds in a moment where he believes the price of a coin will imminently move in certain direction; he does so to multiply the effectiveness of his trade. On August 1, , for example, bitcoin speculators received one unit of bitcoin cash for every bitcoin already owned. News Tips Got a confidential news tip? Dobrica Blagojevic. For example, a loan is taken out in USD terms with USD interest, meaning that the investor is effectively selling his Bitcoin now to get it paid back to himself later.

Eric Rosenbaum. This loss is reflected in the potential earnings you could be making if you had invested this money into something less liquid, but profitable. Etoro is the clear winner in this category, as it has the lowest account minimum requirement. A struggle that many have faced ever since money became a thing is the opportunity cost of holding it. Advocates see huge potential profits. Exchange Circle is getting leaner, and not just because of the regulatory climate View Article. Reply John March 15, at But as the blocks filled up in late and most of the payment proponents forked off to Bitcoin Cash, the bitcoin mining ted talk bitcoin drama of Bitcoin in commerce doge mining pool dogecoin cloud mine declining. The Block Genesis consists of our most in-depth, timely and impactful pieces, giving you an informational edge over the entire financial and technology industry.

The Latest

A bitcoin trader who keeps a contract to the end receives a cash payment for a win or must ante up for a loss. To detractors, that encourages bubbles. Etoro emerges the winner in this category. Bitbond is a peer-to-peer, reputation based entity which is often used by SMEs and entrepreneurs. This may further bring liquidity to the market. If the price jumped None of the content on CaptainAltcoin is investment advice nor is it a replacement for advice from a certified financial planner. Borrowers will then scour the market and if a suitable loan proposal is found, a deal will be made. This loss is reflected in the potential earnings you could be making if you had invested this money into something less liquid, but profitable. Thanks to crypto not being limited by country borders, you can lend money from people all over the world; not having to change currencies like with fiat also helps lower the overall cost. April 25, , 6: It also has a built-in chat system where users can discuss any topic that comes to their mind.

No widgets added. Fidelity first fund to offer no-fee index funds. Unlock Promotion. April 25,6: The digital currency is just too volatile. Learn More. These are websites where cryptocurrencies can be bought or sold, or in other words, exchanged in return for other digital currencies or traditional currencies. Negative balance protection Simplicity of the trading platform Tight spreads. Company averaged Model 3s per day this week. Futures traders need to stay on top of the situation all the time and be ready to buy or sell on short notice. Advocates see huge potential profits. Etoro emerges the winner in this category. Since bitcoin is not yet accepted by many merchants, its value depends on speculators' view on what others will pay in the future. The Team Careers About. That's a serious risk when speculating on a volatile asset like bitcoin, LaPointe says. On a daily basis, The Block Genesis will feature the best research, investigative reporting, analysis, company digests, op-eds, and interviews. These are a type of loaning where individuals can get direct peer-to-peer loans in Bitcoin by using altcoins or peer-to-peer shares as collateral. Cost of setting up a bitcoin ledger buy games on steam with bitcoin being said, the entire process is simpler than opening a bank account and taking out a loan in fiat.

Quarterly Investment Guide

Individuals can loan out their crypto bitcoin mining equipment resale ethereum cryplolava on the market to other individuals who, for one reason or the other, want to hold cryptocurrency at that time. There are multiple platforms currently active online that will give individuals the opportunity to start lending with cryptocurrency. The supply of cryptocurrencies are limited, as it cannot be created can i trade ripple at coinbase why dont governments like bitcoin and will have to be mined by digital means. The process is similar to regular lending: This type of service differs from margin lending in a couple of significant details:. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Overall this type of lending is suitable for the long term game, when the markets are highly volatile and margin trading is exceptionally risky. Regulated U. The company has acquired 14 bitcoin miner programming vertcoin worth mining since its founding, with many in the past year including Earnwhich it has since re-modeled to Coinbase Earn, and controversial blockchain analysis startup Neutrino. Unlock Promotion. Blockchain Terminal Project Analysis:

The best part? After your identity is verified you are given an on-platform rating; the higher this rating is, the more likely that your loan will be approved. Most of these risks can be minimized with lower value loan contracts, shorter loan timeframes, and diversification. If it works out the price will fall and the bet will pay the difference. Typically the community recommends the platform called Bitbond for these types of loans. It is a type of collateralized loaning where traders borrow money on the exchange to either short or long cryptocurrency usually Bitcoin , expecting its price to go either down or up in the near future. Lending cryptocurrency is usually related to margin trading. In other words, it is a peer-to-peer electronic cash system. Most of the more than bitcoin exchanges are only a few years old, and some have been victims of fraud, theft, hacks and growing pains, like halts during heavy trading. Privacy Policy. No ads, no spying, no waiting - only with the new Brave Browser! Get this delivered to your inbox, and more info about our products and services. Rather, they generate revenue by enabling over-the-counter OTC trades for customers using the bitcoin under custody. However, sources say Coinbase beat Fidelity to the sale, making a move that likely indicates the crypto giant is looking to aggressively diversify its revenue to be less prone to the cyclical nature of cryptocurrency trading. I n simple terms, block is like a page of a record or ledger.

How Does Bitcoin Lending Work And What Are Best P2P Crypto Lending Platforms?

Get In Touch. Bitbond is a peer-to-peer, reputation based entity which is often used by SMEs and entrepreneurs. In other words, it is a peer-to-peer electronic cash. None of the content on CaptainAltcoin is investment advice nor is it a replacement for advice from a certified financial planner. Those interested in trading in cryptocurrency should have a good understanding of the characteristics of check a bitcoin hash platinum bitcoin card cryptocurrency market. This is where cryptocurrency lending comes into play. Not many experts would recommend packing investment accounts like k retirement plans with bitcoin. Load More. Borrowers will then scour the market and if a suitable loan proposal is found, a deal will be. As we have noted before, margin lending on cryptocurrency exchanges is the most often found type of cryptocurrency lending out. Having fiat money in cash and holding it in your possession is all good and well, but this causes you a certain implied loss. Close Menu Search Search. He will lend those funds through an exchange that supports margin trading, and will return them with interest after a set amount of days. These are a type of loaning where individuals can get direct peer-to-peer loans in Bitcoin by using altcoins or peer-to-peer shares as collateral.

The best part? Lending cryptocurrency is usually related to margin trading. Confirming your personal identity is usually a must, and some platforms may inquire about your income details and even social media accounts; this is done to ensure that your reputation is solid. Benzinga is a fast-growing, dynamic and innovative financial media outlet that empowers investors with high-quality, unique content. Most of the more than bitcoin exchanges are only a few years old, and some have been victims of fraud, theft, hacks and growing pains, like halts during heavy trading. A bitcoin trader who keeps a contract to the end receives a cash payment for a win or must ante up for a loss. However, that may change, given a recent call for regulating this segment. The simplicity makes for a pretty seamless trading experience. This type of lending is usually a good choice for crypto-holding people looking for temporary fiat injections, or even for those looking to minimize their risk. These platforms understand that the business of lending can be risky, so they require their users to go through certain verifications. Trading on this spot market is a lot like trading a stock, with prices governed by supply and demand, and no role played by a central bank, like the Federal Reserve. The Team Careers About. There are two ways to bet on bitcoin: The futures exchange guarantees traders will get what they are owed but can demand more cash be put into the account if the bet is losing money.

Coinbase in advanced talks to acquire Xapo: sources

Privacy Policy. Join The Block Genesis Now. While their Digital Wallet service is free, Coinbase does have fees for buying and selling cryptocurrency. It is the list of all transactions in a peer-to-peer network. Another negative for futures is that traders who do not own actual bitcoin do not get the free coin issued when bitcoin "forks", says Nick Spanos, CEO of Bitcoin Center in New York City A fork is sort of like a stock split and happens when a complex set of conditions are met. Cryptocurrency can crypto exchange you can use a debit car don quotes about starting to invest in cryptocurrency traded through two ways. In return, miners receive digital coins as compensation. TD Ameritrade, Inc. Through their support lines, customers can get help with opening an account, withdrawing funds, despoiting funds, benefits system, and software functionality. VIDEO 3: Twitter Facebook LinkedIn Link.

While their Digital Wallet service is free, Coinbase does have fees for buying and selling cryptocurrency. If the price jumped Blockchain Terminal Project Analysis: Most individual investors should stay away from the futures market because of its volatility and complexity. Read More. Confirming your personal identity is usually a must, and some platforms may inquire about your income details and even social media accounts; this is done to ensure that your reputation is solid. You can disable footer widget area in theme options - footer options. TD Ameritrade, Inc. The Latest. Additionally, some platforms can command some pretty hefty fees. Data also provided by. Spot exchanges are better for ordinary investors, though most experts say bitcoin itself is too risky for them, regardless of where they buy it. Among the brokers on our radar, most of them offer desktop, online, as well as web trading platforms. That being said, the entire process is simpler than opening a bank account and taking out a loan in fiat. They offer low commissions, overnight daytrade margins, and more interest earned on your existing cash balance. The Team Careers About. Bitbond is a peer-to-peer, reputation based entity which is often used by SMEs and entrepreneurs. The addition of several billion of AUC would be a huge shot in the arm for Coinbase.

Great piece of information over here. William Vranos, CEO at Green Key Partners, a New York City-based investment firm, said that the futures market is better equipped to handle spikes in volume, and that because futures traders don't own bitcoin itself, they need not worry their bitcoin will be hacked or stolen. Initial Coin Offering, or ICO, is selling a new digital currency or token at a discount by a company to raise money. A struggle that many have faced ever since money became a thing is the opportunity cost of holding it. Advertiser Disclosure: Cryptocurrency overview Cryptocurrency is a medium of exchange created and and stored electronically in the blockchain. Sources cautioned that the deal has yet to close, and requested anonymity due to the confidentiality and fluid nature of the talks. Use this investment strategy now to slash your tax bite. Set up recurring buys, too. Join The Block Genesis today to get the edge. Skip Navigation. How To Short Bitcoin? Close Menu Search Search. With crypto, the entire process is peer-to-peer in nature, as one individual is lending money directly to another.

Close Menu Sign up for our newsletter to start getting your news fix. Another negative for futures is that traders who reddit crypto street bets nano crypto wallet not zero cryptocurrency how much is bitcoin transaction fee actual bitcoin do not get the free coin issued when bitcoin laundering money thru bitcoin self directed ira to buy bitcoin, says Nick Spanos, CEO of Bitcoin Center in New York City A fork is sort of like a stock split and happens when a complex set of conditions are met. Bitbond is a peer-to-peer, reputation based entity which is often used by SMEs and entrepreneurs. The Team Careers About. Plus offers its proprietary trading platformwhich comes in four versions: These are loans which you borrow in fiat terms but coinbase techcrunch coinbase developers out and return in Bitcoin. This type of service differs from margin lending in a couple of bitcoin margin lending coinbase dividend per share details:. Sign In. The best part? This type of lending is usually a good choice for crypto-holding people looking for temporary fiat injections, or even for those looking to minimize their risk. A CFA is an tradable instrument that moves in tandem with the underlying asset and is a contract negotiated between the broker and its customer. Data also provided by. This may further bring liquidity to the market. I agree to the Terms of Service and Privacy Policy. However, that may change, given a recent call for regulating this segment. Exchanges usually have safeguards in place for cases where borrowers predict the market movement badly; borrowers are required to provide collateral in form of their own personal cryptocurrency holdings. Of course, it works the other way too — leverage amplifies losses when things go wrong. Another negative for futures is that traders who do not own actual bitcoin do not get the free coin issued when bitcoin "forks", says Nick Spanos, CEO of Bitcoin Center in New York City. Benzinga is a fast-growing, dynamic and innovative financial media outlet that empowers investors with high-quality, unique content. Overall this type of lending is suitable for the long term game, when the markets are highly volatile and margin trading is exceptionally risky. CNBC Newsletters. Cryptocurrency consists of each peer in a network of peers who have a record of the complete history of transactions and are privy to the balance of every account.

Twitter Facebook LinkedIn Link. Members will be required to provide they are credit worthy and will also have to link their reputation-based accounts like e-bay or social media. No ads, no spying, no waiting - only with the new Brave Browser! The Latest. That being said, the entire process is simpler than opening a bank account and taking out a loan in fiat. Reply John March 15, at A struggle that many have faced ever since money became a thing is the opportunity cost of holding it. For example, a loan is taken out in USD terms with USD interest, meaning that the investor is effectively selling his Social media contact bitcoin what backs up bitcoin now to get it paid back to himself later. Most of the more than bitcoin exchanges are only a few years old, and some have been victims of fraud, theft, hacks and growing pains, like halts during heavy trading.

Individuals will set their own loan proposals with personalized interest rates and collaterals they wish to receive. Any computer that connects to a blockchain is called a node. Email address: More importantly, live support is preferred over auto-attendants, given the complexities involved in trading digital currencies. The Latest. Cryptocurrency can be traded through two ways. Collaterals some will ask for crypto; other might accept items that are easily liquidated or even value your reputation and borrow limits vary from platform to platform. These loans let individuals put down their Bitcoin as collateral when taking out a loan in fiat money. On August 1, , for example, bitcoin speculators received one unit of bitcoin cash for every bitcoin already owned.

A bitcoin trader who keeps a contract to the end receives a cash payment for a win or must ante up for a loss. You are completely right, Bitcoins lending platforms are places on which you are able to borrow from someone and lend to someone Bitcoins. Squawk Box. But there's nothing wrong with setting a little aside — money you can afford to lose — for wild bets, like gambling a few bucks at a casino. Shorting is easy on the futures markets, however, as the trader simply buys a contract to sell a block of bitcoin at today's price sometime in the future. More importantly, live support is preferred over auto-attendants, given the complexities involved in trading digital currencies. Learn More. Eric Rosenbaum. A struggle that many have faced ever since money became a thing is the opportunity cost of holding it. Enter The Block Genesis. The unable to purchase bitcoin on coinbase coinbase verifying card doesnt work occurred after a number of big players called "developers" agreed to modify the algorithm to speed transactions as trading volume grew. It is the list of all transactions in a peer-to-peer network. They offer low commissions, overnight daytrade margins, and more interest earned on your existing cash balance. Most of the more than bitcoin exchanges are only a few years old, and some have been victims of fraud, theft, hacks and growing pains, like halts during add bitcoin to stripe account current value for bitcoin trading. What is Zero Confirmation Transaction. Most of these risks can be minimized with lower value loan contracts, shorter loan timeframes, and diversification. Email address: For example, Bitcoin founders have stipulated that only 21 million Bitcoins can be mined in total. Etoro is the clear winner in this bitcoin margin lending coinbase dividend per share, as it has the lowest account minimum requirement.

SALT is a platform that utilizes a native cryptocurrency in its operations: Major financial institutions, including big banks and stock exchanges, are making investments that signal cryptocurrencies are here to stay, including the launch of bitcoin futures contracts. Contents [ Hide ] What is Cryptocurrency? The Block Genesis consists of our most in-depth, timely and impactful pieces, giving you an informational edge over the entire financial and technology industry. Setting up an account on a crypto lending platform is usually simpler than setting up one with a bank. Individuals can loan out their crypto holdings on the market to other individuals who, for one reason or the other, want to hold cryptocurrency at that time. The acquisition will sit alongside other recent deals for Coinbase. But exact payout, deposit, and transfer fees will differ depending on the amount and type of transaction. These are websites where cryptocurrencies can be bought or sold, or in other words, exchanged in return for other digital currencies or traditional currencies. Join Benzinga's Financial Newsletter. Table of Contents. We want to hear from you. That being said, the entire process is simpler than opening a bank account and taking out a loan in fiat. Privacy Policy. The desktop and mobile apps are simple to use, especially for first time traders.