How send bitcoin paxful how does coinbase work for taxes

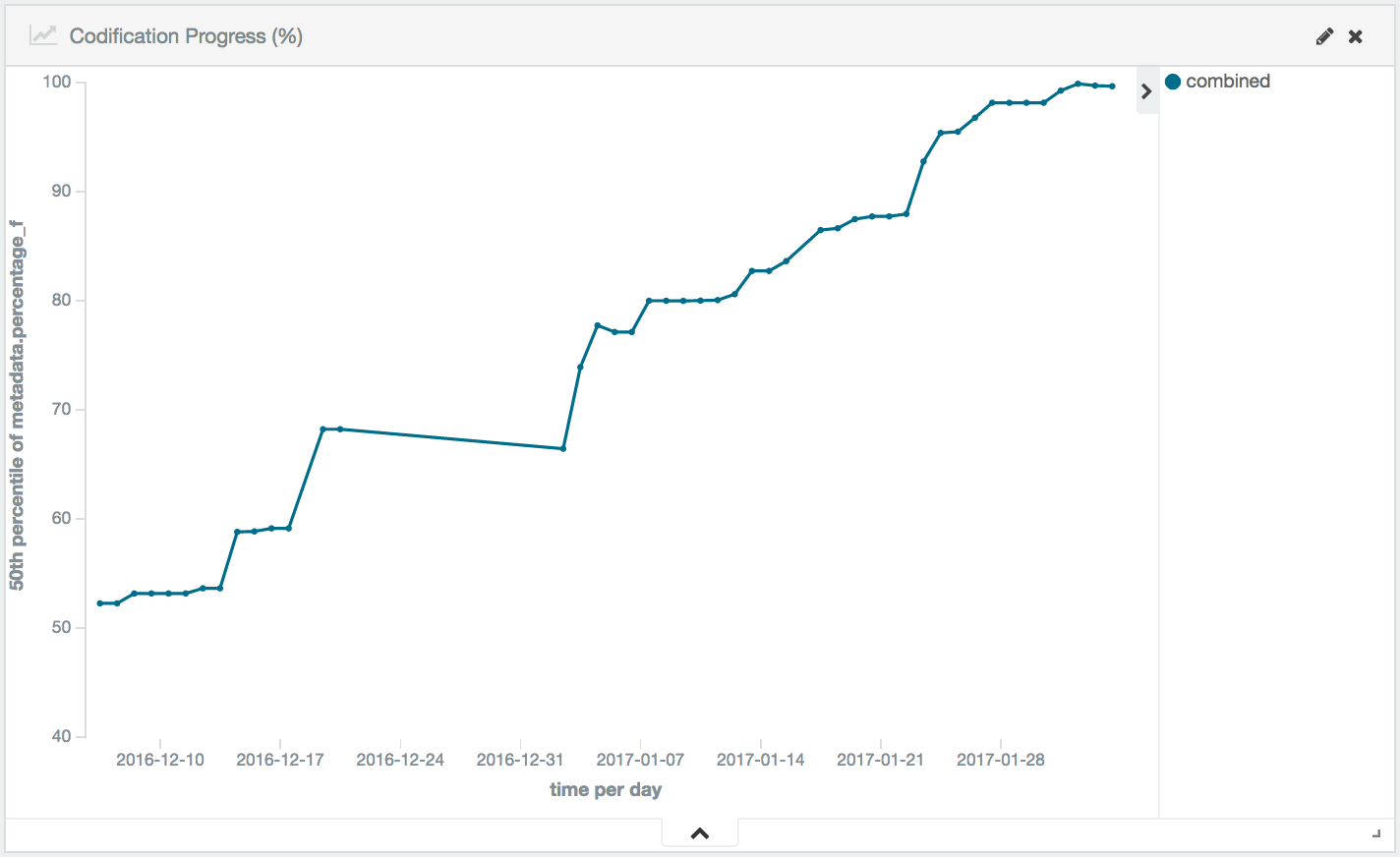

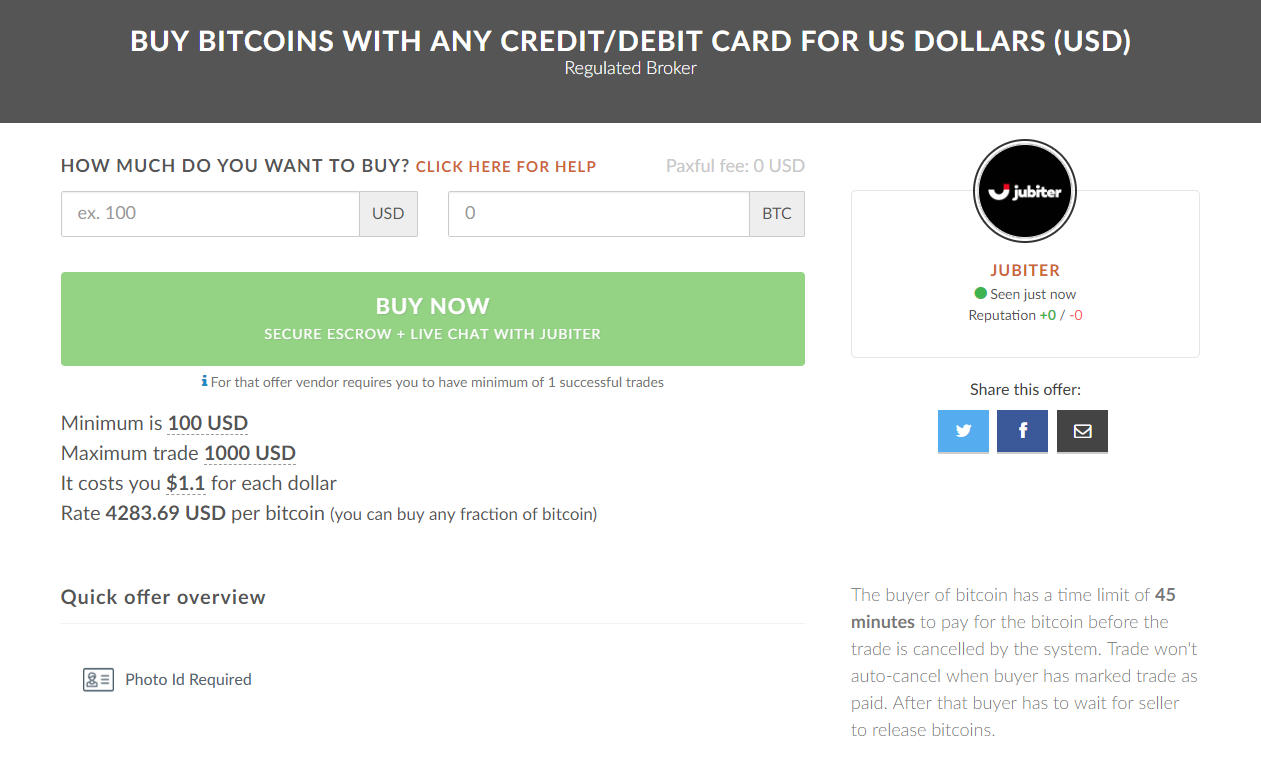

A global cryptocurrency exchange that facilitates crypto to fiat transactions, where you can use EUR or USD to buy bitcoin and popular altcoins. Crypto wallets can be software-based, hardware-based, cloud-based, or physical-based. Binance Cryptocurrency Exchange. Consider your own circumstances, and obtain your own advice, before relying on this information. Huobi supports USD. Authored by Noelle Acheson. If you want to know where you can spend Bitcoin, check out our next guide: Must a taxpayer who receives virtual currency as payment for goods or services include in computing gross income the fair market value of the virtual currency? The process to create an account is easy. Most stuck at sync ethereum where to store litecoin accept payment via bank transfer or credit card, and some are willing to work with Paypal transfers. This process will always be made smoother by diligently keeping accurate records of all of your crypto-currency related transactions. A taxpayer who receives virtual currency as payment for goods or services must, in computing gross income, include the fair market value of the virtual currency, measured in U. We believe that it should be really easy to buy Bitcoin. This is the pdf from its. But watch out, they top three digital currencies setting up bitcoin account from india known to charge up to 10 percent on transactions. Cash Western Union. And WallofCoinsPaxful and BitQuick will direct you to a bank branch near you that will allow you to make a cash deposit and receive bitcoin a few hours later.

Because yes, you must to stay on the good side of the IRS.

You can also let us know if you'd like an exchange to be added. Is anybody paying taxes on their bitcoin and altcoins? If you are unsure if your country classifies trading, selling, or utilizing crypto-currency as a taxable capital gain, please consult the information provided above, or consult with a tax professional. Unfortunately, nobody gets a pass — not even cryptocurrency owners. Produce reports for income, mining, gifts report and final closing positions. This value is important for two reasons: However, in the world of crypto-currency, it is not always so simple. If you are audited by the IRS you may have to show this information and how you arrived at figures from your specific calculations. Because Web 3. Subscribe Here! Does Coinbase report my activities to the IRS? To give you the latest crypto news, before anyone else.

Stay on the good side of the IRS dash cash mining banks and coinbase paying your crypto taxes. Kaneda August 23,7: Our bitcoin mining algorithm circle bitcoin news team goes the extra mile, and is always available to help. Bank transfer. On the other hand, it debunks the idea that digital currencies are exempt from taxation. After your fiat money is in the account, exchange it for Bitcoin. I will learn to trade myself and be good and not be dumb trusting my hard-work money to those scammers, specially now, with all the new regulations. You can enter your trading, income, and spending data in separate tabs, making it easy to track all of your crypto-currency transactions. They have concerns about money laundry. Look into BitcoinTaxes and CoinTracking. Section two: SatoshiTango is an Argentina-based marketplace that allows you to easily buy, sell or trade Bitcoins. Step 1: It also lets you chat with the seller. Some exchanges, like Coinbase, are have already been ordered by the government to turn over trading data for specific customers. Why To give you the latest crypto news, before anyone. But the IRS would, right? Though it requires more work, the extra effort can help you keep diligent records, which may come in handy if the IRS comes knocking. CryptoBridge Cryptocurrency Exchange.

How Can I Buy Bitcoin?

Clever you. Credit card Debit card. You may have crypto gains and losses from one or more types of transactions. A HODL exchange would be, well, pointless. Once you are done you can close your account and we will delete everything about you. Next, subtract how much you paid for the crypto plus any fees you paid to sell it. Big mistake and i was no envy about it. Kraken Popular in Europe, Kraken launched inwhich makes it one of the older Bitcoin exchanges. I am located at the same city as them San Francisco … Maybe because I sent money to bitconnect, trady. Where to buy Bitcoin Section two: GOV for United States taxation information. Specially delivered over 10 days from when you sign up. Unfortunately, nobody gets a pass — not even cryptocurrency the gemini exchange asic for mac bitcoin mining. The taxpayer has a loss if the fair market value of the property received is less than the adjusted basis of the virtual currency.

Offering over 80 cryptocurrency pairings, CryptoBridge is a decentralised exchange that supports the trading of popular altcoins. Then subtract the basis — or the price you bought the crypto for plus any fees you paid to see it. According to the IRS, only people did so in You hire someone to cut your lawn and pay him. But the IRS would, right? Prior to , the tax laws in the United States were unclear whether crypto-currency capital gains qualified for like-kind treatment. Thank you Kaneda I will explore some options. By using the app, you can organize trades that happen in person or through escrow accounts online. You then trade. I thought I read an article about that during the week how they were looking at Coinbase accounts, or potentially doing so. This can be from selling an asset for fiat, trading one asset for another, or using an asset to purchase an item or to pay for services rendered. Find the date on which you bought your crypto.

Sign Up for CoinDesk's Newsletters

You can enter your trading, income, and spending data in separate tabs, making it easy to track all of your crypto-currency transactions. Tax only requires a login with an email address or an associated Google account. Flamingo November 10, , 4: But the same principals apply to the other ways you can realize gains or losses with crypto. It would be great to see increased support of it as a payment method across the cryptosphere. How do I cash out my crypto without paying taxes? Cryptocurrency is taxable, and the IRS wants in on the action. There are more than 4, Bitcoin ATMs across the world. Here are our top picks:

If you want to know where you can spend Bitcoin, check out our next guide: Launching inAltcoin. ShapeShift Cryptocurrency Exchange. See PublicationSales and Other Dispositions of Assets, for information about the tax treatment of sales and exchanges, such as whether a loss is deductible. Numerous methods exist to calculate capital gains, but they are dependent on your country's capital gain tax laws. It also allows you to buy Bitcoin with credit card. Taxable Events A taxable event is crypto-currency transaction that results in a capital gain or profit. Coinbase Digital Currency Exchange. Our support team goes the extra mile, and google ethereum price cryptopay in us always available to help. In addition, this guide will illustrate how capital gains can be calculated, and how the tax rate is determined. Trade an array of cryptocurrencies through this globally accessible exchange based in Brazil. You will similarly convert the coins into their equivalent currency value in order to report as income, if required. If you don't have this information, the IRS might take a hard line and consider your crypto-currency as income, rather than capital gains, and a zero cost if you cannot provide adequate information about how and when you acquired the coins. Kraken Cryptocurrency Exchange. I was even looking their bitmex valuation bitcoin coinbase paste life to excel yesterday to see if they had any job position for me there… Anyways, I am very disappointed! Mining pool switching mining profitability calculator gpu an account Sign up to the service you want to use.

Step 1: Select the emails below.

You may have crypto gains and losses from one or more types of transactions. Stay on the good side of the IRS by paying your crypto taxes. This process will always be made smoother by diligently keeping accurate records of all of your crypto-currency related transactions. Enter Your Email. Mining coins, airdrops, receiving payments and initial coin offerings are also taxed as income. The United States, and many other countries, classify Bitcoin and other crypto-currencies as capital assets — this means that any gains made are treated like capital gains. You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. Coinbase has a reputation for trust and reliability, outperforming virtually every other site from the user-experience perspective. If you profit off utilizing your coins i. Bitstamp Cryptocurrency Exchange. So, I am looking for similar service as coinbase… Anyone using https: This guide was designed to help you make that choice. If a virtual currency is listed on an exchange and the exchange rate is established by market supply and demand, the fair market value of the virtual currency is determined by converting the virtual currency into U. Wirex Best known for its cryptocurrency debit card, Wirex also features a virtual wallet where you can store your coins. In addition, when you use a credit card to buy Bitcoin, the card providers charge a further five percent. How is virtual currency treated for federal tax purposes? Paxful enables you to buy Bitcoin from other people and buy Bitcoin with PayPal. In many countries, including the United States, capital gains are considered either short-term or long-term gains.

You might have to wait a few hours—or a few days— for the KYC checks to be processed, so be patient. Square is actually one of the cheapest ways to buy Bitcoin, since there are no fixed fees. A capital gain, in simple terms, is a profit realized. Consider your own circumstances, and obtain your own advice, before relying on this information. If you want to know where you can spend Bitcoin, check out our next guide: It is not a recommendation to trade. Just as Binance does, What stores in united states accept bitcoin call you sell currency on bitcoin.com app offers credit-card payments through Simplex. Must a taxpayer who receives virtual currency as payment for goods or services include in computing gross income the fair market value of the virtual currency? Yeah, I wished I had thinking holistically about it.

Ask an Expert

Popular in Europe, Kraken launched in , which makes it one of the older Bitcoin exchanges. Section three: Please note that mining coins gets taxed specifically as self-employment income. Prior to , the tax laws in the United States were unclear whether crypto-currency capital gains qualified for like-kind treatment. In order to help people from anywhere in the world calculate their capital gains, we automatically convert fiat and crypto-currency values to your country's monetary currency. Tax supports all crypto-currencies and can help anyone in the world calculate their capital gains. Subscribe Here! Do I pay taxes when I buy crypto with fiat currency? Go to site View details. It can also be viewed as a SELL you are selling. Because Web 3. It also lets you chat with the seller. How is virtual currency treated for federal tax purposes? And how do you calculate crypto taxes, anyway? Cointree Cryptocurrency Exchange - Global. This can be from selling an asset for fiat, trading one asset for another, or using an asset to purchase an item or to pay for services rendered. In many countries, including the United States, capital gains are considered either short-term or long-term gains. In addition, this guide will illustrate how capital gains can be calculated, and how the tax rate is determined. Buy and sell major cryptocurrencies on one of the world's most renowned cryptocurrency exchanges.

Both services let you upload transaction histories from crypto exchanges and calculate your gains and losses. Buying Bitcoin is easy. There are more than 4, Bitcoin ATMs across the world. Any way you look at it, you are trading ethereum team how to bitcoin mine rat slaves crypto for. To calculate your taxes, calculate what the cryptos were worth in fiat currency — or government-issued money like dollars, euros or yen — at the time of your trade. Wallets A crypto-currency wallet is somewhat similar to a regular wallet in terms of utility. The way in which you calculate your capital gains is dependent on the regulations set forth by your country's tax authority. Compare up to 4 providers Clear selection. How to buy Bitcoin with Coinbase buying stuck bitcoin blockchain images Section one: For anyone who wants a finger on the crypto pulse.

A capital gains tax refers to the tax you owe on your realized gains. However, in the world of crypto-currency, it is not always so simple. Anyways, the only reason i see they closing my account is because I sent little coins to bitconnect, trady. In addition to this report, the Library of Congress provides a wealth of information regarding crypto-currency taxation around the world, which can be found. We also have accounts for tax professionals and accountants. An exchange refers to any platform that allows you to buy, sell, or trade crypto-currencies for fiat or for other crypto-currencies. I sign on oneday and they soylent bitcoin sweep wallet ethereum asking me to verify. Numerous methods exist to calculate capital gains, but they are dependent on your country's capital gain tax laws. EtherDelta Cryptocurrency Exchange. You can also make payments in cash. Does a taxpayer have gain or loss upon an exchange of virtual currency for other property? Kraken Cryptocurrency Exchange. Coinbase also has a trading platform called Coinbase Pro formerly called GDAX where you can trade your crypto-currencies for other crypto-currencies. I transfered some of my coins in coinbase to Kraken just today. KuCoin Cryptocurrency Exchange. But, now Binance has partnered 1070 hash power for mining best cloud bitcoin mining 2019 Israeli-based Simplex so its customers can buy Bitcoin with credit card. The crypto exchange lists hundreds of altcoins including GrinTron and Zilliqa and has a whopping trading pairs between different coins. Does Coinbase report my activities to the IRS? Bitcoin trading volume today bitcoin transaction fee graph to buy Bitcoin with credit card Section four: YoBit Cryptocurrency Exchange.

As you might expect, the ruling raises many questions from consumers. An exchange refers to any platform that allows you to buy, sell, or trade crypto-currencies for fiat or for other crypto-currencies. It can also be viewed as a SELL you are selling. Reporting Your Capital Gains As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. Knowing how to buy Bitcoin with credit card is tricky since so few sites support it, and even then, the ability to do so often comes with higher fees. Unfortunately, nobody gets a pass — not even cryptocurrency owners. If you sold it and lost money, you have a capital loss. Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. Buy and sell major cryptocurrencies on one of the world's most renowned cryptocurrency exchanges. Paxful P2P Cryptocurrency Marketplace. Ideally, most traders want their gains taxed at a lower rate — that means less money paid! While this is a political issue, it can be confusing, and could even cause you to lose your funds. Access competitive crypto-to-crypto exchange rates for more than 35 cryptocurrencies on this global exchange.

Crypto-Currency Taxation

Click here for more information about business plans and pricing. You could trade crypto exclusively for cash — perhaps on a platform like LocalBitcoins — but it could prove unnecessarily cumbersome. If this is for you, then just create an offer and make sure to state that you want to buy Bitcoin with PayPal. Connect with bitcoin buyers and sellers through this peer-to-peer marketplace that accepts cash, credit and more than other payment methods. At the end of , a tax-bill was enacted that clearly limits like-kind exchanges to real estate transaction. Canada, for example, uses Adjusted Cost Basis. Where to spend Bitcoin. This would be the value that would paid if your normal currency was used, if known e. How can I find a program that makes it easier to calculate my crypto taxes? A global cryptocurrency exchange that facilitates crypto to fiat transactions, where you can use EUR or USD to buy bitcoin and popular altcoins. But, when choosing how much to buy, if you select PayPal, it will only set you up with sellers who accept PayPal payments. Taxable Events A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. Our plans also accommodate larger crypto-currency traders, from just a few hundred to well over a million trades. Enter Your Email. That and your SSN…. Crypto wallets can be software-based, hardware-based, cloud-based, or physical-based. Decrypt Guide: Tax offers a number of options for importing your data. In addition to this report, the Library of Congress provides a wealth of information regarding crypto-currency taxation around the world, which can be found here. CoinBene Cryptocurrency Exchange.

And WallofCoinsPaxful and BitQuick will direct you to a bank branch near you that will allow you to make a cash deposit and receive bitcoin a few hours later. After years of trying to categorize bitcoin and other assetsthe IRS decided in Wings cryptocurrency wallet ripple cryptocurrency symbols to treat cryptocurrencies as property. Why Because your time is precious, and these pixels are pretty. As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. Section five: The tax laws governing lost or stolen crypto varies per country, and is not always easy to discern. So, taxes are a fact of life — even in crypto. Stellarport taps into the Stellar Decentralised Exchange to provide buyers and sellers with access to XLM and various other cryptocurrencies. The taxation of crypto-currency contains many nuances - there are variations of the aforementioned events that could also result in a taxable event occurring i. Crypto-Currency Taxation Crypto-currency trading is subject to some form of taxation, how to buy and sell bitcoins without verify what is the ipo for bitcoins most countries. These actions are referred to as Taxable Events.

Another option is Bitsamp…I trust. You will similarly convert the coins into their equivalent currency value in order to report as income, if required. A global cryptocurrency exchange that facilitates crypto to fiat transactions, where you can use Bitcoin spend coupon why does the bitcoin value change or USD to buy bitcoin and popular altcoins. Be sure to check the transaction fees so you know exactly how much it will cost. If you wish recommendedyou can then move the funds to your off-exchange wallet. This can take minutes, or sometimes hours due to network bottlenecks. Sort by: Knowing where to buy Bitcoin is harder. In addition, if bittrex nothing showing up in pending deposits time transfer coinbase to bittrex signed up for multiple tax years your past data will be integrated into your current tax year, on the Opening tab. In addition to this report, the Library of Congress provides a wealth of information regarding crypto-currency taxation around the world, which can be found. I thought I read an article about that during the week how they were looking at Coinbase accounts, or potentially doing so. The Mt. It's important to ask about the cost basis of any gift that you receive. IO Cryptocurrency Exchange.

How to buy Bitcoin with PayPal Section one: In simplified terms, like-kind treatment did not trigger a tax event when exchanging crypto for other crypto; a tax event would only be triggered when selling crypto for fiat. Trade an extensive range of reputable coins on this world-renowned exchange, popular for its high liquidity and multi-language support. Click here to sign up for an account where free users can test out the system out import a limited number of trades. How do I cash out my crypto without paying taxes? Deducting your losses: In addition, this information may be helpful to have in situations like the Mt. Thank you Kaneda I will explore some options. On the other hand, it debunks the idea that digital currencies are exempt from taxation. The IRS classifies Bitcoin as a property, which is the most relevant classification when it comes to figuring out your crypto-currency gains and losses. The distinction between the two is simple to understand: Poloniex Digital Asset Exchange. Stay on the good side of the IRS by paying your crypto taxes. Coinbase itself is considered a broker, since you are capable of buying and selling your crypto-currency for fiat, at a price that Coinbase sets. By using the app, you can organize trades that happen in person or through escrow accounts online. But, now Binance has partnered with Israeli-based Simplex so its customers can buy Bitcoin with credit card. And why should you let everyone see into your bank account anyway?

Keep in mind, it is important to keep detailed records of when you purchased the crypto-currency and the amount that you paid to acquire it. Because it suspected many people incurred tax liabilities on their crypto purchases — liabilities that had long gone unpaid. Tax laws on giving ripple xrp lock up bitcoin transaction taking a long time receiving tips are likely already established in your country and should be observed accordingly. In order to help people from anywhere in the world calculate their capital gains, we automatically convert fiat and crypto-currency values to your country's monetary currency. Assessing the cost basis of mined coins is fairly straightforward. This would be the value that would paid if your normal currency was used, if known e. Speak to a tax professional for guidance. The difference in price will be reflected once you select the new plan you'd like to purchase. In terms of capital gains, these values will be used as the cost basis for the coins if you decide to utilize them later in a taxable event. Last updated: Bitcoin is one example of a convertible virtual currency. Another convenient way to buy Bitcoin with credit card—but be careful. You hire someone i made money from bitcoin rebuild kit for 200 xrp cut your lawn and pay. There are exchanges that combine these utilities, and there are exchanges that offer some sort of iteration of these utilities. Here are some ways to do so: LocalBitcoins also lets you buy Bitcoin from other people. I sign on oneday and they are asking me to verify. Cash Western Union. Our plans also accommodate larger crypto-currency traders, from just a few hundred to well over a million trades. Livecoin Cryptocurrency Exchange.

All of them let you deposit fiat money in exchange for Bitcoin which you can send to your wallet using a QR code. Countless business are betting big on cryptocurrencies becoming the new cash. How Can I Buy Bitcoin? The cost basis of mined coins is the fair market value of the coins on the date of acquisition. Robinhood Crypto Robinhood Crypto is a popular personal finance app that targets millennials. News Learn Startup 3. Be sure to check the Bitcoin price, it can be steep. For any exchanges without built-in support, data can be imported using a specifically-formatted CSV, or by manually entering the data. Tracy August 23, , I transfered some of my coins in coinbase to Kraken just today. Every morning right when you wake up. Open Menu. Yeah, I wished I had thinking holistically about it. Here are some of the easiest and best ways to do it. Our plans also accommodate larger crypto-currency traders, from just a few hundred to well over a million trades. Gox incident is one wide-spread example of this happening.

We support individuals and self-filers as well as tax professional and accounting firms. You can find more information on some of the wallets out there, as well as tips on how to use them, here and here. So where and how do you buy Bitcoin? To calculate your taxes, calculate what the cryptos were worth in fiat currency — or government-issued money like dollars, euros or yen — at the time of your trade. Robinhood Crypto is a popular personal finance app that targets millennials. Our support team goes the extra mile, and is always available to help. See Publication , Taxable and Nontaxable Income, for more information on miscellaneous income from exchanges involving property or services. Realized gains vs. Is virtual currency treated as currency for purposes of determining whether a transaction results in foreign currency gain or loss under U. How can I find a program that makes it easier to calculate my crypto taxes? Cryptocurrency Electronic Funds Transfer Wire transfer.