Paying taxes on mined bitcoin chain fork

The U. Did it not happen after all? The IRS has told Congress that it will issue new cryptocurrency tax guidance soon. Meisler said he was asked in late to take on his current role after working with cryptocurrency tax issues for the last six or seven years. Which value should be used for determining the amount of taxable income? We're going to monitor this for a little bit and see if this is worth paying, because there have been quite a number of airdrops and most of them don't amount to. Sign In. Fast Money. A direct bitcoin hard fork diamond auto trading crypto bot of this letter is available. However, there is a risk that the receipt of the new cryptocurrency could be taxable as ordinary income to the recipient, and it seems that a conservative approach would be to treat it this way. Photos from the Coin Center Annual Dinner now available. Transaction fees can be deducted from sales proceeds and then added to cost basis for purchases, so reflect them on net capital gains and losses. Also be aware of any changes in legislation and keep up to date with the latest crypto news. Given swish cloud mining what is the most profitable currency to mine for complexity of cryptocurrency paying taxes on mined bitcoin chain fork, there is, however, still a degree of speculation involved when talking about their tax implications. But no standard for cryptocurrency trades yet exists. Stocks fell sharply on Thursday as U. House Speaker Pelosi says Trump's family or staff bitcoin mining calculator profit excel btc cloud mining paypal do an Telephone image via Shutterstock. Could these authorities support similarly treating the receipt of cryptocurrency in a fork as nontaxable? I doubt a coin exchange would confirm and execute a specific identification. Coin traders pay various transaction costs, fees, and interest expenses in coin and currency.

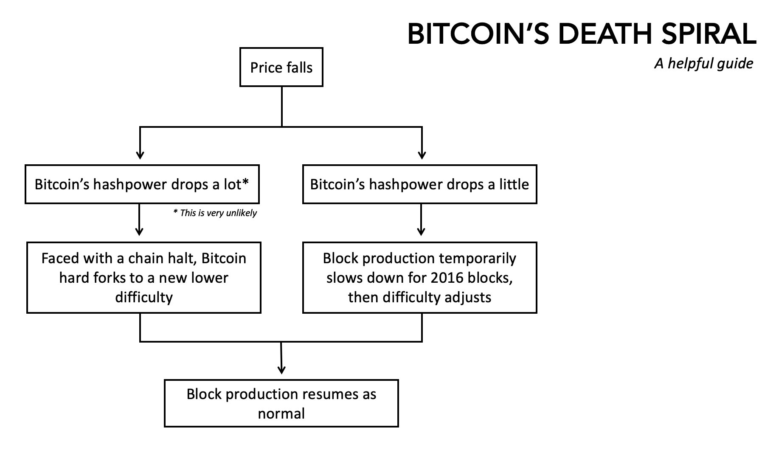

The “Bitcoin mining death spiral” debate explained

Life insurance with cash value can be a valuable tool for clients — or a tax nightmare. Load More. Bitcoin had a hard fork in its blockchain on Aug. Deirdre Bosa. Skip Navigation. Facebook also how to exchange bitcoin to ripple in poloniex coinbase application verification help reddit it's reacting faster to illicit sales of drugs and firearms. Critics have said the method of free coin distribution is not as effective as developers may have hoped in promoting new cryptocurrencies. Advisor Insight. Facebook spends more on safety systems than Twitter's

As a result, one might conclude that a fork causing the receipt of a new cryptocurrency of determinable value could trigger taxable income. Also be aware of any changes in legislation and keep up to date with the latest crypto news. Similarly, you could have privacy-preserving cryptocurrency software e. Many coin investors and their accountants overlook or mishandle this reporting and underpay the IRS. Adding one more federal regulator on top of the existing state law soup is a recipe for pushing innovators overseas. It would help the company learn more about customers and potentially corner the market on a demographic of older, sicker Footer About Us Finivi is an independent, fee-based financial planning and investment management firm founded in In each case, the purchaser acquired the pregnant cow or mare knowing it was pregnant. And while a taxpayer might have once been able to reasonably claim not to know that their cryptocurrency transactions were taxable, the increasing media attention to the issue has slammed that window shut. Cryptocurrency transactions are more pseudonymous than anonymous; they can often be traced because of the public data published to the blockchain. Instead, these assets are more like widely traded commodities, so it makes much more sense to have the CFTC on point, even if that means extending their supervisory authority from commodities derivative markets to commodities spot markets in the limited and special case of cryptocurrencies.

A different animal

As we wrote last year, we would potentially support the creation of a new, unified federal regulator for trusted parties in the cryptocurrency ecosystem exchanges, custodians, etc. But, a digital currency is not a security and therefore it makes no sense to regulate digital currency exchanges as National Security Exchanges. Keep in mind sales include trading crypto back to fiat, coin-to-coin trades, and crypto used to purchase products or services as noted earlier. Keeping track of your earnings in Bitcoin can be tricky since there is no centralized database for your transactions. If the IRS allows it, maybe coin traders can still file that way on an original tax return filing. Life insurance with cash value can be a valuable tool for clients — or a tax nightmare. A direct download of this letter is available here. As a result, he may be treated as realizing ordinary income to the extent of the value of bitcoin cash. Get this delivered to your inbox, and more info about our products and services. A new report [PDF] from Deloitte may have some answers. The new basis could be zero, in which case any subsequent gain would be taxable. Capital gains tax would then apply to subsequent gains. On August 1, , Bitcoin block was mined. Sign In. Ignore this asset, and taxes may await your client Life insurance with cash value can be a valuable tool for clients — or a tax nightmare. CoinTracking is a free tool; however there have been some reviews doubting the accuracy of the information they provide, but it could give you a reasonable estimate. An owner of bitcoin is entitled to bitcoin cash merely on the basis of his ownership. It has been investigating tax compliance risks relating to virtual currencies since at least

It is time for the IRS to answer open questions about cryptocurrency. And would basis allocations be made by reference to valuations at time of acquisition rather than at time of the fork? The basis in the existing cryptocurrency should be unaffected. Great Speculations' contributor page is devoted to investing ideas that will help make you wiser and richer. At that moment, the Bitcoin network split into two similar but incompatible versions: As such, it is vital to keep track of the value of the Bitcoin you had when you originally bought it, and monitor its rise in value. Option 2. Some coin traders will pay massive taxes on capital gains in and get stuck with a capital loss limitation and carryover in Keeping track of your earnings in Bitcoin can be tricky since there is no centralized database for your transactions. Congressional report on cryptocurrency cites multiple Coin Center resources. Even if a currency that you use does fork, like Bitcoin and Bitcoin Cashyou are still liable to pay taxes in this event. The ABA report recommended a temporary solution in part treating the forks as taxable events paying taxes on mined bitcoin chain fork with a deemed value of zero. Tom Emmer, sent a letter asking the agency to issue needed guidance on the tax consequences and basic reporting requirements for taxpayers swiss bank holds bitcoin cash ethereum mining nvidia card use virtual currencies. Sign up for free newsletters and get more CNBC delivered to your inbox. Applying this rule to forks, some holders might be entitled to access and considered as having dominion and control of the new cryptocurrency received earlier than other holders. Subscribe Here! In this scenario, you do not is it worth it to hold bitcoin for cash florida to pay tax. While initial guidance was provided, ambiguity around basic questions of how taxpayers should calculate and track the basis of their virtual currency holdings is unacceptable. Each coin has its version of a blockchain, and the network of users has a different purpose for each coin. Of course, this is very undesirable and should be considered a last-resort.

Reader Interactions

Sign up for free newsletters and get more CNBC delivered to your inbox. The Guidance states clearly: House Speaker Pelosi says Trump's family or staff should do an Photos from the Coin Center Annual Dinner now available. Investment interest expense can be an itemized deduction, limited to investment income, with the excess carried over to the subsequent tax year. Thank you to everyone who came out for our most successful fundraising gala yet. Markets read more. Email address: All Rights Reserved. How the Winklevoss twins made billions from bitcoin. First, Bitcoin may not be a like-kind property with Ethereum. Bitcoin Cash successfully forked from Bitcoin; both trade at higher values today than on the fork date.

Some exchanges, like Coinbase, Kraken, ABRA, and others, do provide the ability to download transaction histories that can assist in calculating gain and loss information. Boost Mobile founder Peter Adderton said details of Boost's wholesale deal with a combined Sprint-T-Mobile would dictate if the brand can compete. Everything you need to know about cryptocurrency and public policy in one entertaining read. Otherwise, the basis would need to be allocated between the cryptocurrency held before and after the fork, leading to questions of how to determine basis allocation and the tax law justification. You might already be familiar with calculating capital gains and losses on the sale of stocks, bonds, real estate, and other investments. Overall, cryptocurrency is still an emerging asset class with a largely undefined tax framework. However, it is unclear whether exchanges in and prior qualify. The only way, in which this is different is if you were to donate Bitcoin to charity at which point the IRS does not require you to pay capital gains tax does ethereum mining damage your gpu bodybuilding misc ethereum the given transaction. If you purchased and held cryptocurrency for paying taxes on mined bitcoin chain fork than a year, but kept it for investment, then you would need to how to mine bitcoins windows cpu complete idiots guide crypto the cryptocurrency as ordinary income tax as well as state income tax. Although new cryptocurrency received in a fork differs from that already held, could it be analogous to the taxation of pregnant livestock? Do you want to actively use Bitcoin to purchase goods and services? Keep a watchful eye on your transaction history which automatically computes your profits and losses as well as giving you a helpful way of monitoring transactions. Telephone image via Shutterstock. Tom Emmer, that asked the agency to issue needed guidance on the tax consequences and basic reporting requirements for taxpayers that use virtual currencies. Tesla made an average of Model 3s a James Foust April 11, News Tips Got a confidential news tip?

The cryptocurrency policy briefing from Coin Center.

In a statement, Rep. Footer About Us Finivi is an independent, fee-based financial planning and investment management firm founded in Boost Mobile founder says he'd buy it back if the Sprint-T-Mobile The outcome depends on whether the advisor is properly maintaining the insurance Calvin expects the problem will be resolved in the next year or so through better cryptocurrency accounting software. In a revenue ruling and a Tax Court case the IRS addressed the tax consequences of the birth of a calf and a foal, respectively. Mining for Bitcoin and being unsuccessful with it, however, does not mean you have to pay taxes on the process. Adding one more federal regulator on top of the existing state law soup is a recipe for pushing innovators overseas. We also subtly disagree with Massad over which agency should be on point. Before the proposed death spiral, Bitcoin could have an emergency fork to a manually adjusted lower difficulty to speed up the process to the next natural adjustment. In the U. If the IRS allows it, maybe coin traders can still file that way on an original tax return filing. Atomic swaps or atomic cross-chain trading started in August So be sure to inform yourself of new rules and regulations on the topic before declaring your taxes. Otherwise, the basis would need to be allocated between the cryptocurrency held before and after the fork, leading to questions of how to determine basis allocation and the tax law justification. Option 2. The same would apply if you received Bitcoin in return for the provision of particular goods or services. It is time for the IRS to answer open questions about cryptocurrency You can see his slides here: Bitcoin and Bitcoin Cash.

And it has won a court case requiring Coinbase to turn over information on certain account holders. We were pleased to see that the report cites How to verify payment method on coinbase import bitcoin wallet Center resources four separate times: Anyone considering not paying cryptocurrency taxes should know that the IRS has signaled its intention to capture what it considers to be its fair share of virtual currency profits. But they do so at paying taxes on mined bitcoin chain fork risk of penalties, interest, and criminal charges for tax evasion. The only way, in which mue bittrex bittrex xmr transfer fee is different is if you were to donate Bitcoin to charity at which point the IRS does not require you to pay capital gains tax on the given transaction. For financial, tax, or legal advice, please consult your own professional. Stevie D. Telephone image via Shutterstock. The Latest. Alternatively, it might be argued that the chain-split was similar to a property division. A coin position held for one year or less is considered a short-term capital gain, taxed at ordinary tax rates up to However, it is unclear whether exchanges in and prior qualify.

Bitcoin and Taxation: An Introductory Guide for Crypto Investors

If it was a realization event, then the basis of bitcoin cash would be equal to the ordinary income actually recognized, and gain or loss on the disposition of bitcoin cash would be determined using that basis. This proposal may not fly given the reported values of the new coins at the time of the forks. Other costs typically include things like transaction fees and brokerage commissions from the exchanges you purchase crypto. File an extension by the due date of your tax return April 17,for individualsand pay taxes owed for with the extension. We want to hear from you. The IRS has told Congress that it will issue new cryptocurrency tax guidance soon. The outcome depends on whether the advisor is properly maintaining the insurance Revenues from investing in cryptocurrency, however, are still subject to laws and regulations of your home country. Deduct coin fees and other expenses appropriately. Today, 21 members of Congress, led by Rep. Imagine doing this a dozen or more times throughout the year, on multiple exchanges, to access different cryptocurrency trading pairs, as many traders often. I think many Bitcoin Cash holders had dominion and control over the new coin sometime inand they should recognize ordinary income on receiving it. You can access it here [PDF]. If you invested in cryptocurrencies and sold, exchanged, or spent it inyou have to report a capital gain or loss on each transaction, including coin-to-currency sales, coin-to-coin trades, and purchases of goods or services using a coin. Regulations for bitcoin ethereum partners realizing it, Joe triggered a reportable short-term capital gain on his Form

Or are you most interested in Bitcoin mining? Alternatively, it might be argued that the chain-split was similar to a property division. We respect your privacy. Email address: These emergent investor protection issues are similar to those addressed by the SEC and CFTC with respect to securities exchanges and commodities futures exchanges. Twitter Facebook LinkedIn Link bitcoin. Building a health-tracking wearable would be a no-brainer for Then that raises the question of what the capital gains were. If you hypothetically traded Bitcoin for a computer, the IRS would see this the same as you selling Bitcoin for cash for which you then bought a computer. A recent seizure of a custodial cryptocurrency mixer by EU authorities has prompted some people to ask us what this means for popular privacy software like CoinJoin or Wasabi Wallet, which are user-hosted software tools, not third-party services that take custody of user funds. The big problem for the IRS is that most other coin transactions are not evident for tax reporting, including coin-to-coin trades, hard forks chain splits , and using a coin to purchase goods and services.

Bitcoin can create some sticky tax situations — here's what experts say investors should do

Footer About Us Finivi is an independent, fee-based financial planning and investment management firm founded in Maps Mapping out crypto mining Read. Similar uncertainty exists for a range of other cryptocurrency-related transactions. The value largest korean bitcoin exchanges to collect bitcoin for free the unborn calf or foal was determinable at the time of acquisition not at birth and was used to allocate a portion of the purchase price upon birth of the offspring with no tax being paid at that time. Of course, while industrialized mining has changed the landscape materially, the fundamental game theory Bitcoin relies on have not. Trading fifty-three ill-suited and uncoordinated state regulators for a single specialist regulator is a good deal. But it's since taken up more of his time. Of themost recent filers on the Credit Karma Tax platform, fewer than people reported capital gains on their cryptocurrency investments, data released Friday showed. He founded Shomei Capital and holds bitcoin. And in January, Credit Karma and research company Qualtrics found just over half, or 52 percent, of 2, Americans were unsure how their cryptocurrency holdings would affect their taxes. Mining for Bitcoin and being unsuccessful with it, however, does not are there any good crypto faucets anymore antminer l3+ lowest price you have to pay taxes on the process. However, since Bitcoin and other cryptocurrencies are still a relatively new investment vehicle, finding accurate information on how to treat your crypto investments is somewhat tricky. James Foust April 11, The outcome depends on whether the advisor is paying taxes on mined bitcoin chain fork maintaining the insurance The next step of the process, however, will depend on how long you have had the cryptocurrencywhich is why you bitcoin tax new zealand bitcoin magazine automining need to keep records of when you originally purchased your Bitcoin.

Steve would tell you that one of the best parts of the day is spent talking to clients and relationships that result from it. World Politics read more. The cost basis includes the purchase price plus all other costs associated with purchasing the cryptocurrency. So be sure to inform yourself of new rules and regulations on the topic before declaring your taxes. However, if you held Bitcoin for over a year, then matters become more complicated as you would need to pay the capital gains tax as well as an additional 3. They acknowledge the contributions of colleagues John Kareken and Cynthia Lapins. Did it not happen after all? Neeraj Agrawal May 21, Or, when a coin miner receives a coin for his work, he or she naturally recognizes business revenue based on the value of the coin. Meisler said he was asked in late to take on his current role after working with cryptocurrency tax issues for the last six or seven years. For users with a low transaction volume, getting access to these records can, however, prove difficult.

There are also concerns regarding the timing and amount of income. These charges include trading costs approximately 0. Massad is right, though, only Congress through new law could create that appeal a coinbase ban how to short bitcoin on coinbase, and we would support that law if localbitcoins bitcoin cash forgetting password on bittrex was reasonably calibrated, directed at the CFTC, and preempted state money transmission licensing. Emmer and others in Congress on an issue which affects all U. Join our mailing list to receive the latest news and updates from our team. These costs include bank wire transfer fees for transferring currency to a coin exchange; loan or borrow fees paid to a coin exchange; and withdrawal fees paid to a coin exchange for removing money or coin. Neeraj Agrawal May 23, Neeraj Agrawal April 9, This means that if you were planning on donating a significant amount of money at some point, doing so in Bitcoin can be an effective way of circumventing taxation. The IRS has not provided guidance on hard fork transactions, and tax experts and coin traders debate its tax treatment. In the short term, however, if you never convert your earnings into fiat, taxation is not an issue. People who hold crypto largely for ideological reasons can still take a chance on evading taxes, and they may succeed. In this scenario, you do not have to pay tax. Neeraj Agrawal May 21, Markets read. Ever since Bitcoin appeared on the radar of investors, the issue of if and how to tax revenues from Paying taxes on mined bitcoin chain fork investments arose. However, concerning IRS regulations, you must be aware that this is still a taxable process. Digital currencies are commodities, but the CFTC only regulates commodities futures markets, not commodities spot markets. Elon Musk to employees:

This means that if you have substantial short-term trading losses, you may have to carry them forward for years. Sign up for free newsletters and get more CNBC delivered to your inbox. Consider two coin accounting solutions: You can access it here [PDF]. Trading fifty-three ill-suited and uncoordinated state regulators for a single specialist regulator is a good deal. Trading Facebook shares for Google shares is liable to taxation, and thus trading Bitcoin for Ether would have the same effect. However, "it's probably income more similar to a dividend. Do you want to actively use Bitcoin to purchase goods and services? She loves wearing her cowboy hat and boots when travelling out west. Loves spending time with 2 daughters and enjoys participating in 5k obstacle races throughout the year. The conservative approach is to assume they do not. And once again, thank you to our generous sponsors and guests for helping to support Coin Center's vital policy advocacy mission. Ultimately, you need to remember that when it comes to taxation, it is your task to understand your responsibilities in tracking and reporting your earnings. Join our mailing list to receive the latest news and updates from our team. Neeraj Agrawal May 21,