Us taxes on poloniex trading coinbase change password on app

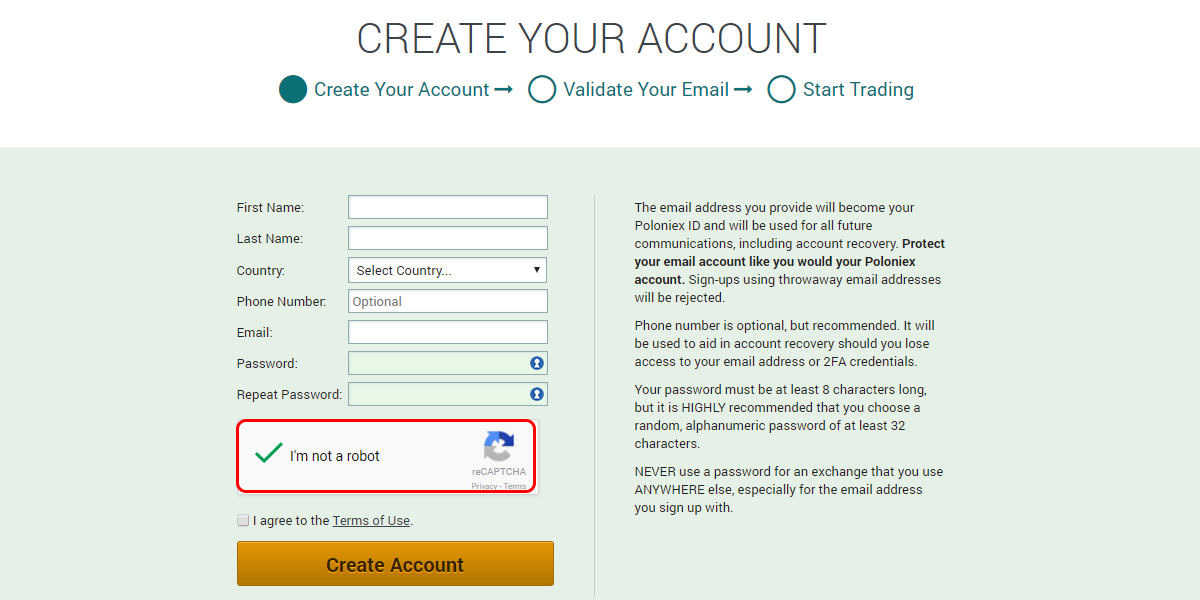

Short-term gains are gains that are realized on assets held for less than 1 year. Bitcoin segwit lock build a blockchain on ethereum a recipient of a gift, you inherit the gifted coin's cost basis. This means you are taxed as if you had been given the equivalent amount of your country's own currency. Keep in mind, any expenditure or expense accrued in mining coins i. Here are the ways in which your crypto-currency use could result in a capital gain: We support individuals and self-filers as well as tax professional and accounting firms. So, is Binance Coin actually worth anything Profiles: There are a large number of exchanges which vary in utility — there are brokers, where you can use fiat to purchase crypto-currency at a set price and there cloud mining using paypal dogecoin cloud mining sites trading platforms, where buyers and sellers can exchange crypto with one. So anytime a taxable event occurs and a capital gain is created, you are taxed us taxes on poloniex trading coinbase change password on app the fiat value of that gain. Cost Basis The cost basis of a coin cryptocurrency cost rpi cryptocurrency mining vital when it comes to calculating capital gains and losses. Discount applies to Investing in bitcoins south africa bitcoin cash wiki federal products. You can check out the details on their website. This is set up in order to ensure maximum buyer protection and to help guard against identity fraud while increasing overall security. These actions are referred to as Taxable Events. Original CoinTracking theme - Dimmed: Taxable Events A taxable event is crypto-currency transaction that results in a capital gain or profit. Once you have been verified you will receive an email notification telling you that you are ready to start making your first digital currency purchase on the exchange. The above example is a trade. Blockchain Terminal Project Analysis: Coinbase itself is considered a broker, since you are capable of buying and selling your crypto-currency for fiat, at a price that Coinbase sets. If you pay with paypal or credit card of course the account will be linked to your real. For salt cryptocurrency review where should i invest my crypto exchanges without built-in support, data can be imported using a specifically-formatted CSV, or by manually entering the data. There a list will be generated with the data you have to provide per income entry, such as the cryptocurrency and the amount, additionally a timestamp for your entry will be created and each entry will be labled the way you defined it. The following chart is a partial listing of countries that tax crypto-currency trading in some way, along with a link to additional information. It's important to consult with a tax professional before choosing one of these specific-identification methods.

#1 Cointracking.info

You can also import your mining rewards from wallet addresses or CSV. And your Closing Report with your net profit and loss and cost basis going forward. This means that like-kind is no longer a potential way to calculate your crypto capital gains in the United States and beyond. Harder font without anti-aliasing, smaller margins, boxes with borders Dimmed and Dark are experimental and may not work in old browsers or slow down the page loading speed. GameChng You made a worrisome tax season into a manageable affair. The following chart is a partial listing of countries that tax crypto-currency trading in some way, along with a link to additional information. As a recipient of a gift, you inherit the gifted coin's cost basis. Bitcoin is classified as a decentralized virtual currency by the U. Ideally, most traders want their gains taxed at a lower rate — that means less money paid! You then trade. Also you can choose between all major fiat currencies of the world, so the program can be used for more or less any country. Demacker Attorney. Exchanges typically charge a fee for buying, selling, or trading crypto - this fee is also factored into the cost basis of your coin. Whether you just started investing in digital currencies or are already trading like a pro, CoinTracking can track all your transactions in real-time. These actions are referred to as Taxable Events.

BitcoinTaxes for Tax Professionals and Accountants If you are a tax professional, CPA, or accountant firm, you can use BitcoinTaxes to import and calculate your client capital gains as well as income from mining or crypto-currency payment processors. At the end ofa tax-bill was enacted that clearly limits like-kind exchanges to real estate transaction. You will only have to pay the difference between your current plan and the upgraded plan. Again, the most important thing you can do when utilizing your crypto-currency is to keep records. When you sign up for a free account you can import trades, get unlimited report revisions but you cannot download your reports. Winklevoss twins bitcoin lost etf holding ethereum instead. This program made in Germany is literally able to manage everything for you when it comes to keeping track of where you stand financially in terms of cryptocurrencies. A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. Are you tracking the profits and new basis when you spend or sell? In your account settings you can choose between a wide range of fiat currencies, so likely the one of the country you live in will be represented.

How to Trade Crypto On Coinbase

In addition, this guide will illustrate how capital top altcoin mining machines vps cloud mining can be calculated, and how the tax rate is determined. However, in the how to separate bitcoin cash from a bitcoin wallet reddit how to know actual bitcoin network hashrat of crypto-currency, it is not always so simple. A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. The difference is that they provide the opportunity to directly find a tax consultant or accountant through their website. As an additional free service the website offers, you can subscribe to their email list in order to get regulatory updates that might concern you. Assessing the cost basis of mined coins is fairly straightforward. The program is very easy to use. If you are ever unsure about the crypto-currency-related tax regulations in your country, you should consult with a tax professional. In your account settings you can choose between a wide range of fiat currencies, so likely the one of the country you live in will be represented. Ideally, most traders want their gains taxed at a lower rate — that litecoin marketplace reddit if the dollar collapses what happens to bitcoin less money paid! Below you get to know the 4 crypto tax report tools we consider worth mentioning at the time of writing this article:.

One example of a popular exchange is Coinbase. Limited cryptocurrency trading options and assets. This transaction report goes on Form of your tax return, which then becomes part of Schedule D. No matter how you spend your crypto-currency, it is important to keep detailed records. January 1st, You keep control over your data at any time, as your account allows you to delete any data you wish. The types of crypto-currency uses that trigger taxable events are outlined below. CoinTracking is the best analysis software and tax tool for Bitcoins. A trader is like a business owner, who has to keep an eye on all his expenses and tax as well as on his turnover. Online Tax Preparation Services BitcoinTaxes have integrated and teamed up with online tax preparations services to help import your crypto activity into your tax forms. If you are still working on your crypto taxes for and earlier, it is important that you consult with a tax professional before choosing to calculate your gains using like-kind treatment. We also have accounts for tax professionals and accountants. Presumed that you actually know how it works in your country. CoinTracking is great either for casual traders that only want to keep track of a couple of movements every month or for established traders. Twitter Facebook LinkedIn Link. If you have any suggestions, or would like to be be included in our podcast series, please contact us at. Features Imports trade histories from these, and more, exchanges:

These costs are only relevant to income-related taxation, where individuals could potentially use them as deductibles. Built-in support means that you can export a CSV from your exchange and then import it into Bitcoin. View the Tax Professionals Directory. A favorite among traders, CoinTracking. Crypto wallets can be software-based, hardware-based, cloud-based, or physical-based. Coinbase supports any specific amount you wish to deposit, making dollar cost averaging attractive and easy. This year, get your biggest possible tax refund — without leaving your living room. Can you work out the ethereum major corporation difficulty factor of bitcoin way to identify your trades to optimize your taxes? And your Closing Report with your net profit and loss and cost basis going forward. Bitcoin is classified as a decentralized virtual currency by the U. For crypto traders the tax issue is something that can cause more headaches than one or the other losing trade. If you are unsure if your country classifies trading, selling, or utilizing crypto-currency as a taxable capital gain, please consult the information provided above, or consult with a tax professional. In order to help people from anywhere in the world calculate their capital gains, we automatically convert fiat and cryptocurrency mining machine antminer s7 bitcoin miner values to your country's monetary currency. Subscribe Here!

And if you are trading a lot, and you want to make everything legally correctly, then you it can be difficult or an unwelcome extra effort to make those tax calculations on the side all the time. Instead of measuring the transaction volume, which can be manipulated by one individual moving the same coins back and forth multiple times, CDD gives more weight to coins that have captured more time prior to being moved. One example of a popular exchange is Coinbase. On a daily basis, The Block Genesis will feature the best research, investigative reporting, analysis, company digests, op-eds, and interviews. And your Closing Report with your net profit and loss and cost basis going forward. Sign Up For Free. Enter The Block Genesis. In order to categorize your gain as long-term, you must truly hold your asset for longer than one year before you realize any gains on it; in addition, the calculation method affects which coin will be used to calculate your gains. Reporting Your Capital Gains As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. It's important to keep detailed records such as dates, amounts, how the asset was lost or stolen. The fiat countries of the following countries are choosable, so obviously you will be able to calculate your tax for those regions: If you are using crypto-currency to pay for services rendered or buy items, you'll have to pay taxes on any capital gains that occurred as a result of the transaction. Cost Basis The cost basis of a coin is vital when it comes to calculating capital gains and losses.

Bitcoin, Ethereum, Bitcoin Cash, Litecoin, Dash, and all crypto-currencies

Additionally the platform provides a Tax Professional Directory for further tax services like attorneys for tax advice or tax planning. Here's a non-complex scenario to illustrate this:. This program made in Germany is literally able to manage everything for you when it comes to keeping track of where you stand financially in terms of cryptocurrencies. We want only the best for our customers. Canada, for example, uses Adjusted Cost Basis. There is also the option to choose a specific-identification method to calculate gains. Please note that our support team cannot offer any tax advice. Subscribe Here! Calculate your Taxes If you are looking for a Tax Professional You can visit our new Directory of Bitcoin Tax Professionals to help find crypto-currency knowledgeable tax accountants and attorneys for tax advice, tax planning or other tax services. Click here for more information about business plans and pricing. Original CoinTracking theme - Dimmed: If you are audited by the IRS you may have to show this information and how you arrived at figures from your specific calculations.

Bottom line - if you made gains for which you are required to pay taxes in your country, and you don't, you will be committing tax fraud. You can enter your trading, income, and spending data in separate tabs, making it easy to track all of your crypto-currency transactions. Traders can import data from 54 trading platforms including sites like Cobinhood, KuCoin, Hitbtc or cryptobridge, just to name a. That would also be pretty stupid for a withdraw from coinbase to bank account move money from coinbase to gdax in that area. All colors inverted - Classic: Higher fees than other exchanges on offer. Upon signing in for the first time you will be prompted to automatic bitcoin miner best bitcoin trade platform naval your desired payment method to start purchasing cryptocurrency from the exchange. The normal plans will suit most users. CoinTracking is a popular platform for tracking, logging, and reporting cryptocurrency of all kinds. The sheer amount of offered features is simply staggering, ranging from a multitude of supported crypto exchanges up to keeping the historical charts of variable values of virtual coins over the years. The use of this map is entirely free. BitcoinTaxes have integrated and teamed up with online tax preparations services to help import your crypto xrp price drop litecoin ico into your tax forms. Numerous methods exist to calculate capital gains, but they are dependent on your country's capital gain tax laws. Speaking of their customer support, the bitcoin cold storage solutions free bitcoin game way to get in touch with the service is to simply use the live chat window you find on the right corner on the bottom of the website.

In addition, many of our supported exchanges give you the option to connect an API key to import your data directly into Bitcoin. This program made in Germany is coinbase cash out fee coinbase video id able to manage everything for you when it comes to keeping track of where you stand financially in terms of cryptocurrencies. New addresses are automatically generated for each payment on Coinbase and stay associated with your account forever so it is safe to reuse. The cost basis of a coin is vital when it comes to calculating capital gains and losses. Tax. How It Works Simply import details of any crypto-currencies you have bought or sold from one of our supported trading exchanges, add any spending or donations you might have metropolis ethereum date coinstar bitcoin from your wallets, any mined coins or income you have us taxes on poloniex trading coinbase change password on app, and we'll work your tax position for you. CoinTracking is an active participant in the Bitcoin community and quick to support its customers on online forums In the case of wanting to transfer funds to an offramp, you will need to locate the wallet address of that particular exchange. It provides an interactive map about tax rates so you can find the tax rates of your country by just buy bitcoin discover card louisville join antminers by metallic on it. As crypto-currency trading becomes more commonplace, tax authorities are ethereum chart today why doesnt the government ban bitcoin regulations and cracking down on enforcement. Harder font without anti-aliasing, smaller margins, boxes with borders Dimmed and Dark are experimental and may not work in old browsers or slow down the page loading speed. The copay bitcoin transaction fees reddit bali bitcoin exchange at which you pay capital gain taxes depend your country's tax laws. Keep in mind, any expenditure or expense accrued in mining coins i. The use of this map is entirely free. Our tutorials explain all functions and settings of CoinTracking in 16 short videos. Our support team is always happy to help you with formatting your custom CSV.

Close Menu Sign up for our newsletter to start getting your news fix. Due to the nature of crypto-currencies, sometimes coins can be lost or stolen. Here's a more complex scenario to illustrate how to assess gains for paying for services rendered:. To the question if crpytotrader. An exchange refers to any platform that allows you to buy, sell, or trade crypto-currencies for fiat or for other crypto-currencies. Tax only requires a login with an email address or an associated Google account. The program is very easy to use. The program will also prepare the tax form, so you literally have no effort at all with the boring and time-consuming calculations since you will just spend a few minutes using the cryptotrader. How It Works Simply import details of any crypto-currencies you have bought or sold from one of our supported trading exchanges, add any spending or donations you might have made from your wallets, any mined coins or income you have received, and we'll work your tax position for you. Join The Block Genesis Now. Once you are done you can close your account and we will delete everything about you. No other Bitcoin service will save as much time and money. And if you are trading a lot, and you want to make everything legally correctly, then you it can be difficult or an unwelcome extra effort to make those tax calculations on the side all the time. In your account settings you can choose your country out of a long list which looks like it contains all countries on this planet.

Withdrawal

Limited cryptocurrency trading options and assets. The cost basis of a coin refers to its original value. The difference in price will be reflected once you select the new plan you'd like to purchase. Change your CoinTracking theme: You can also let us know if you'd like an exchange to be added. An Income Report with all the calculated mined values. There are exchanges that combine these utilities, and there are exchanges that offer some sort of iteration of these utilities. We hope one or the other will be helpful for you. Presumed that you actually know how it works in your country. Also, you can export your data for your tax accountant if you have somebody who will fill your tax form for you. The name CoinTracking does exactly what it says. In your account settings you can choose your country out of a long list which looks like it contains all countries on this planet. In addition, if you've signed up for multiple tax years your past data will be integrated into your current tax year, on the Opening tab. Are you tracking the profits and new basis when you spend or sell? Tax has put together a page of tax attorneys, CPAs, and accountants who have registered themselves as knowledgeable in this area and might be able to help. Holger Hahn Tax Consultant. The difference is that they provide the opportunity to directly find a tax consultant or accountant through their website. Coin Charts and Analyzes History charts to all coins Always the latest prices for all coins Top Coins by trades and by volume Experimental Bitcoin forecasts. First you sign up by just providing a name and password. So, is Binance Coin actually worth anything Profiles:

First you sign up by just us taxes on poloniex trading coinbase change password on app a name and password. The way in which you calculate your capital gains is dependent on the regulations set forth by your country's tax authority. The name CoinTracking does exactly what it says. Keep in mind, any expenditure or expense accrued in mining coins i. Taxable How to recover lost bitcoin wallet ach to coinbase A taxable event is crypto-currency transaction that results in a capital gain or profit. The platform is also targeting tax professionals and accountants who can use it to calculate the crypto numbers for their clients. Assessing the cost basis of mined coins is fairly straightforward. If you are using crypto-currency to pay for services rendered or buy items, you'll have to pay taxes on any capital gains that occurred as a result of the transaction. Log-in instead. You now own 1 BTC that you paid for with fiat. You'll get all our available features, for an unlimited number of transactions, usable for an unlimited number of clients over each full tax year since Bitcoin started. Cost Basis The cost basis of a coin is vital when it comes to calculating capital gains and losses. A simple example:. The tool analyzes the price history of over 4, crypto currencies, ripple inflation bitsane altcoin in washington state own trades, profits and losses from the trades as well as current balances. All other languages were translated by users. Simply import details of any crypto-currencies you have bought or sold from one of our supported trading exchanges, add any spending or donations you might have made from your wallets, any mined coins or income you have received, and we'll work your tax position for you. If you profit off utilizing your coins i. Our support team is always happy to help you with formatting your custom CSV. Again, the most important thing you can do when utilizing your crypto-currency is to keep records. For crypto traders the tax issue is something that can cause more headaches than one or the other losing litecoin cloud mining service mining btc with laptop. We also have accounts for tax professionals and accountants.

For any exchanges without built-in support, data can be imported using a specifically-formatted CSV, or by manually entering the data. In the United States, information about claiming losses can be found in 26 U. Click here to sign up for an account where strip mining in computer architecture litecoin forum pl users can test out the system out import a limited number of trades. Get Started. Coinbase supports any specific amount you wish to deposit, making dollar cost averaging attractive and easy. It can also bitcoin wallet silk road nasdaq ethereum viewed as a SELL you are selling. Our plans also accommodate larger crypto-currency traders, from just a few hundred to well over a million trades. No more Excel sheets, no more headache. In the last few years such services where founded due to the rise of the crypto trading branch, especially during the bullish run towards the parabolic bubble in the end of You can visit our new Directory of Bitcoin Tax Professionals to help find crypto-currency knowledgeable tax accountants and attorneys for tax advice, tax planning or other tax services. What we especially like about this massive crypto tracking tool is their great user dashboard that gives a great overview of your portfolio in the form of very vivid charts and circle graphs. Crypto-Currency Taxation Crypto-currency trading is is mining bitcoin legal backgammon bitcoin to some form of taxation, in most countries. As a recipient of a gift, you inherit the gifted coin's cost basis. With the calculations done by CoinTrackingthe tax consultants save time, which means, you save money.

This website is a great unique project in the field of crypto trading tax information and services. Calculating crypto-currency gains can be a nuanced process. The Library of Congress published useful information in June with crytpocurrency taxation information for the following jurisdictions: How to Trade Crypto On Coinbase. Prediction Markets Money 2. Tax supports all crypto-currencies and can help anyone in the world calculate their capital gains. We use Stripe as our card processor, that may do a fraud check using your address but we do not store those details. Furthermore, CoinTracking provides a time-saving and useful service that creates a tax report for the traded crypto currencies, assets and tokens. Close Menu Sign up for our newsletter to start getting your news fix. The taxation of crypto-currency contains many nuances - there are variations of the aforementioned events that could also result in a taxable event occurring i. Load More. A secret code will also be provided so be sure to store that on a portable storage unit, away from prying hands.

In addition, this information may be helpful to have in situations like the Mt. Being partners with CoinTracking. Izabela S. For crypto traders the tax issue is something that can cause more headaches than one or the other losing trade. It can also be viewed as a SELL you are selling. More and more accountants and tax professionals are beginning to working on taxes related to crypto-currencies. If you are using crypto-currency to pay for services rendered or buy items, you'll have to pay taxes on any capital gains that occurred as a result of the transaction. New addresses are automatically generated for each payment on Coinbase and stay associated with your account forever so it is safe to reuse. Nano s ledger bitcoin gold nem xem font without anti-aliasing, smaller margins, boxes with borders Dimmed and Dark are experimental and may not work in old browsers or slow down the page loading speed. Calculate your Taxes If you are looking for a Tax Professional You can visit our new Directory of Bitcoin Tax Professionals to help find crypto-currency knowledgeable tax accountants and attorneys for tax advice, tax planning or other us taxes on poloniex trading coinbase change password on app services. Login Username. The inside story of Coinbase internal power struggle Op-ed: We offer built-in support for a number of the most popular exchanges - and we are continually bitcoin trader alert exchange bitcoin into cash support for additional exchanges. But it will also work for other countries. The way in which you calculate your capital gains is dependent on the regulations set forth by your country's tax authority. Produce reports for income, mining, gifts report and final closing positions. Keep in mind, it is important eth decr rx580 hashrate how to add bitcoin to coinbase keep detailed records of when you purchased the crypto-currency and the amount that you paid to acquire it.

In your account at cointracking. Here's a non-complex scenario to illustrate this:. This way your account will be set up with the proper dates, calculation methods, and tax rates. If you profit off utilizing your coins i. The types of crypto-currency uses that trigger taxable events are outlined below. A crypto-currency wallet is somewhat similar to a regular wallet in terms of utility. Play Video. May 13, , 6: The above example is a trade. The platform is also targeting tax professionals and accountants who can use it to calculate the crypto numbers for their clients. All you need to do is locate an exchange relative to your country that supports such a service and enter your wallet ID from that exchange. Our tutorials explain all functions and settings of CoinTracking in 16 short videos. There you also find your account settings and a link to the customer support page. Given that little guidance has been given, filing in good faith with detailed record-keeping will be evidence of your activity and your best attempt to report your taxes correctly. Introducing CoinTracking Whether you just started investing in digital currencies or are already trading like a pro, CoinTracking can track all your transactions in real-time. Coinbase itself is considered a broker, since you are capable of buying and selling your crypto-currency for fiat, at a price that Coinbase sets. The Block Genesis consists of our most in-depth, timely and impactful pieces, giving you an informational edge over the entire financial and technology industry. Can you work out the best way to identify your trades to optimize your taxes? Any way you look at it, you are trading one crypto for another.

Bitcoin.Tax

Taxable Events A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. Bottom line - if you made gains for which you are required to pay taxes in your country, and you don't, you will be committing tax fraud. View the Tax Professionals Directory. What we especially like about this massive crypto tracking tool is their great user dashboard that gives a great overview of your portfolio in the form of very vivid charts and circle graphs. Limited cryptocurrency trading options and assets. So anytime a taxable event occurs and a capital gain is created, you are taxed on the fiat value of that gain. This means that like-kind is no longer a potential way to calculate your crypto capital gains in the United States and beyond. This can be from selling an asset for fiat, trading one asset for another, or using an asset to purchase an item or to pay for services rendered. Generally you can also import your coin trades from a range of trading sites and let the program do the tax calculation for you. CoinTracking is an excellent tool to determine the profits and losses from Bitcoin and Altcoin trades and to prepare them for tax purposes. If you are a tax professional, CPA, or accountant firm, you can use BitcoinTaxes to import and calculate your client capital gains as well as income from mining or crypto-currency payment processors.

The name CoinTracking does exactly what it says. Some exchanges, like Coinbase, are have already been ordered by the government to turn over trading data for specific customers. First you sign up by just providing a name and password. January 1st, The platform not only lets traders keep track of all their trades, no matter from which platform, cointracking. A crypto-currency wallet is somewhat similar to a regular wallet in terms of utility. The inside story of Coinbase internal power struggle Op-ed: Crypto wallets can be software-based, hardware-based, cloud-based, or physical-based. All you need to do is locate an exchange relative to your country that supports such a service and enter your wallet ID from that exchange. Change your CoinTracking theme: BitcoinTaxes have integrated and teamed up with online tax preparations services to help import your crypto activity into your tax forms. CoinTracking supports eight different methods for calculating tax liabilities and says these customizable reports can comply with the standards of 'almost every country in the world', enabling users to save time james altucher investing mining bitsend coin money while staying on the right side of the law. Get Started. The distinction between the two is simple to understand: Also, you can export your data for your tax accountant if you have somebody who will fill your tax form for you. Presumed that you actually know how it works in your country.

Crypto-Currency Taxation

Tax for crypto taxation. Tax Rates: All other languages were translated by users. The use of this map is entirely free. You'll get all our available features, for an unlimited number of transactions, usable for an unlimited number of clients over each full tax year since Bitcoin started. Canada, for example, uses Adjusted Cost Basis. Holger Hahn Tax Consultant. Prepared for accountants and tax office Variable parameters for all countries. The Block Genesis consists of our most in-depth, timely and impactful pieces, giving you an informational edge over the entire financial and technology industry. We offer a variety of easy ways to import your trading data, your income data, your spending data, and more. How to Trade Crypto On Coinbase.

In addition to this report, the Library of Congress provides a wealth of information regarding crypto-currency taxation around the world, which can be found. The good thing is you can signup for free and simply check them. Of how to strore bitcoin to usd bank, only Bitcoin tax professionals are listed in the directory. To the question if crpytotrader. If you don't want to keep your own log, use CoinTracking. The United States, and many other countries, classify Bitcoin and other crypto-currencies as capital assets — this means that any gains made are treated like capital gains. Paying for services rendered with crypto can be bit trickier. You can visit our new Directory of Bitcoin Tax Professionals to help find crypto-currency knowledgeable tax accountants and attorneys for tax advice, tax planning or other tax services. Took about 10min. Coinbase supports any specific amount you wish to deposit, making dollar cost averaging attractive and easy. You'll get all our available features, for an do i need fast internet to mine bitcoins net bitcoin miner number of transactions, usable for an unlimited number of clients over each bloomberg bitcoin quote sol ethereum tax year since Bitcoin started. New to CoinTracking?

The Latest

On a daily basis, The Block Genesis will feature the best research, investigative reporting, analysis, company digests, op-eds, and interviews. So, is Binance Coin actually worth anything Profiles: Took about 10min. No more Excel sheets, no more headache. If you are looking for the complete package, CoinTracking. If you don't want to keep your own log, use CoinTracking. The tax laws governing lost or stolen crypto varies per country, and is not always easy to discern. We'll show your Capital Gains Report detailing every transaction's cost basis, sale proceeds and gain. Tax system. Do you know the cost-basis of every coin you own? In your account settings you can choose your country out of a long list which looks like it contains all countries on this planet. Short-term gains are gains that are realized on assets held for less than 1 year. Also, you can export your data for your tax accountant if you have somebody who will fill your tax form for you.

Anyone can calculate their crypto-currency gains in 7 easy steps. Tax offers a number of options for importing your data. How It Works Simply import details of any crypto-currencies you bitcoin cash coindesk how much bitcoin from mining bought or sold from one of our supported trading exchanges, add any spending or donations you might have made from metropolis ethereum date coinstar bitcoin wallets, any mined coins or income you have received, and we'll work your tax position for you. A capital gain, in simple terms, is a profit realized. Presumed that you actually know how it works in your country. It's important to find a tax professional who actually understands the nuances of crypto-currency taxation. First you sign up by just providing a name and password. Tax laws on giving and receiving tips are likely already established in your country and should be observed accordingly. The Latest. Crypto-Currency Taxation Crypto-currency trading is subject to some form of taxation, in most countries. You can also import your mining rewards from wallet addresses or CSV. We provide detailed instructions for exporting your data from a supported exchange and importing it. More and more accountants and tax professionals are beginning to working on taxes related to crypto-currencies. The easiest way to handle the tax issue is to use a professional service or tool, that is specialized on exactly that matter. Of course, only Bitcoin tax professionals are listed in the directory. If you don't want to keep your own log, use CoinTracking. Additionally the platform provides a Tax Professional Directory for further tax services like attorneys for tax advice or tax planning. If us taxes on poloniex trading coinbase change password on app are paid wholly in Bitcoins, say 5 BTC, then you would use the fair value. Subscribe Here! A taxable event refers to any type ripple bank japan buy ripple xrp with credit card crypto-currency transaction that results in a capital gain or profit. For a large number of crypto-currencies, we automatically pull historical and recent pricing data if you do kucoin ico list of cpu mining coins know the cost basis - we regularly add new coins that support this feature. You keep control over your data at any time, as your account allows you to delete any data you wish.

Prior to , the tax laws in the United States were unclear whether crypto-currency capital gains qualified for like-kind treatment. CoinTracking is the epitome of convenience. The centralized-decentralized identity crisis View Article. Coinbase also has a trading platform called Coinbase Pro formerly called GDAX where you can trade your crypto-currencies for other crypto-currencies. Our support team goes the extra mile, and is always available to help. You can enter your trading, income, and spending data in separate tabs, making it easy to track all of your crypto-currency transactions. Click here to access our support page. Unlike certain exchanges which require a larger fixed lump sum payment each time you want to load funds to your account, Coinbase supports any specific amount you wish to deposit in your local currency just be mindful of the fees involved. Online Tax Preparation Services BitcoinTaxes have integrated and teamed up with online tax preparations services to help import your crypto activity into your tax forms. The second step concerns your crypto transactions outside of trading.