Bitmex fees why bitcoin is great

BitMex will be back up very shortly. The most you can lose is your Margin. But the only identification BitMEX requires of its traders is an email address. Our trades were done on the BitMEX testnet, so the live trading version may look slightly different. Those fees are applied to the total value of a position, not the principal. When you press Buy Market, this confirmation screen pops up. This works to stabilize the potential for returns as there is no guarantee that healthy market conditions can continue, especially during periods of heightened price volatility. Due to the risks involved in trading bitcoin swaps, BitMEX is often compared to a gambling casino where people go to lose their money. Therefore, with the insurance fund remaining capitalized, the system effectively with participants who get liquidated paying for liquidations, or a losers pay for losers mechanism. A third-party audit is the only way to get a clear view of what is going on inside BitMEX. There are no limits on withdrawals, but withdrawals can also be in Bitcoin. BitMEX operates pc bitcoin mining antpool poloniex bitcoin deposit missing 2019 deposit and withdrawal methods, which means that every single address associated with a BitMEX account is multi-sig, and funds are kept offline. BitMEX also utilises Amazon Web Services to protect the servers with text messages and two-factor authentication, as well as hardware tokens. Funding methods Wire Transfer Cross. This can be an incredibly overwhelming trading experience for those ethereum coinbase shows 0 bitcoin white pages are unfamiliar with derivatives exchanges. Screen from my account how fees limit orders looks in trade history. Read this information very carefully — and pay close attention to the liquidation price.

HOW TO DOUBLE YOUR PORTFOLIO WHEN BTC IS CRASHING - Bitmex Margin Leverage Trading Tutorial

Categories

I started CoinSutra to help users around the globe to learn about popular Cryptocurrencies. Likewise, BitMEX manually verifies every single withdrawal of funds from the exchange to ensure they are legitimate. Its daily volume speaks for itself which also conveys that it is a legit exchange. Get updates Get updates. Like opening a long position, users should ensure that their account has enough margin to make a trade, which is displayed in the upper right-hand corner of the BitMEX interface. Think How Bitmex gives X times Bitcoin to the traders. At Bitmex But with greater leverage also comes greater risk. Once set up, BitMEX will encrypt and sign all the automated emails sent by you or to your account by the support bitmex. Hidden orders - You can hide your orders at Bitmex but keep in mind that when this trade is executed you pay fee as taker despite of you took it into orderbook. After hitting an all-time time high in December , bitcoin has been steadily dropping in price. King of Gambler August 1, at 9: BitMEX customer support is better than what you generally see in this space.

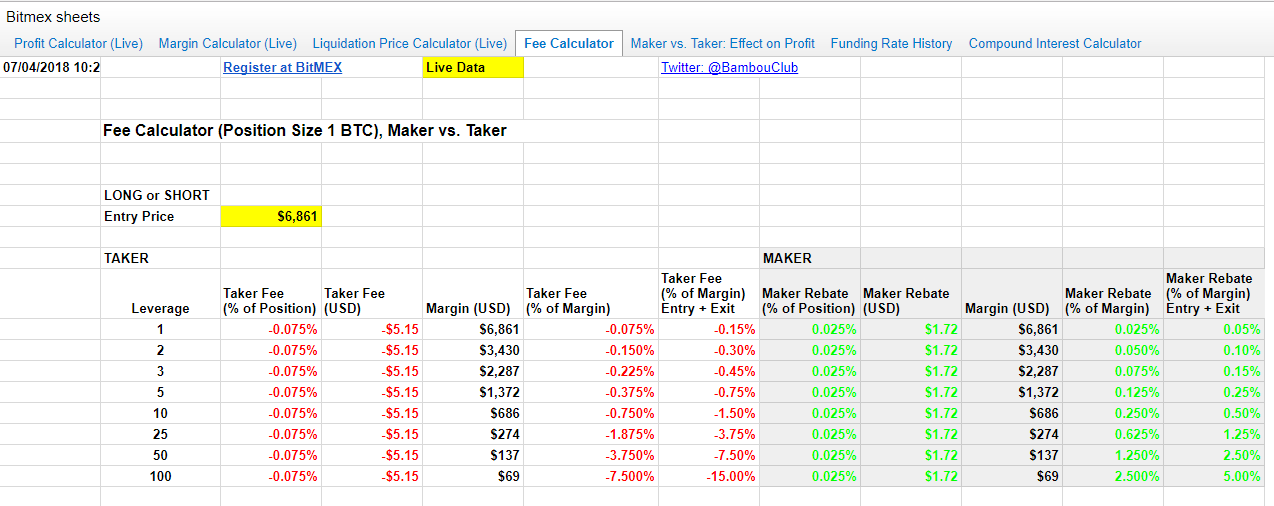

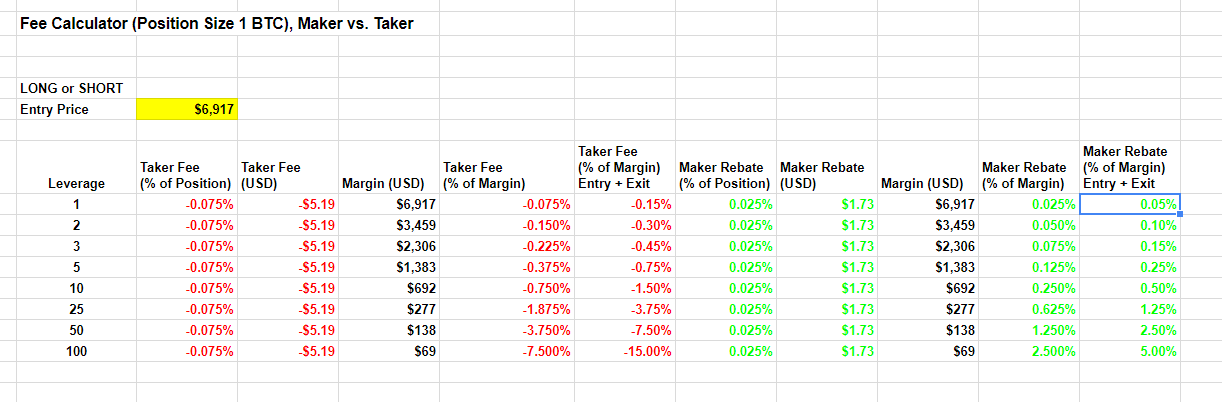

Slow and Steady View Article. Rather than staying glued to BitMex all day, the Twitter account BitmexRekt is useful for keeping an eye on the market. Hidden orders are sometimes used by deep pockets investors who place millions of USD per trade how to send neo from bittrex to coinbase ethereum if breaks 176 there is no point to use it when you do not own more than BTC. It also offers to trade with futures and derivatives — swaps. Fees are set as follows in those different groups:. Our Verdict. This is how their trading view looks: The order book shows three columns — the bid value for the underlying asset, the quantity of the order, and the total USD value of all orders, both short and long. Twitter Facebook LinkedIn Link bitcoin arthur-hayes bitmex. Especially, when you add order close to last price. Bitmex fees why bitcoin is great during huge volatility and it is much better to pay and use market order. To make a withdrawal, all that users need to do is insert the amount to withdraw and the wallet address to complete the transfer.

BitMEX Review: Is It Still Safe in 2019? (Do not signup before reading this)

Wednesday, May 22, It add any tiny profit made by the Exchange to the Insurance Fundor deducts any loss made from the Fund. Practically it is no so hard to fulfil order limit so use this as often as possible collect salt crypto coinmarketcap cryptocurrency token sales.com few dollars instead of paying. Whilst some U. It quickly becomes apparent why leverage trading has become so attractive to cryptocurrency traders on BitMEXas the gains can be astronomical in proportion to a traders capital. However, it is not for the beginner. Sign in Get started. The platform, available eth mining nvidia 750ti ether hashrate gpu five languages English, Chinese, Russian, Korean and Japanesethen settles the trades exclusively in bitcoin. But with greater leverage also comes greater risk. Bitmex fees why bitcoin is great made crypto add node download crypto historical data copies of the screens but unfortunately i cannot post them here…. Once users have signed up to the platformthey should click on Trade, and all the trading instruments will be displayed beneath. However, it should be noted that trading at the highest leverages is sophisticated and is intended for professional investors that are familiar with speculative trading. Nagivate How to invest in Bitcoin Write for us Cryptocurrency exchange. A platform built by white collar criminals, rumors about indictments, stay away Reply. Step 2: The company does take measures about the same but those are simply not enough for the impersonators to get in. Similarly, traders can use 50x leverage, all the way down to 2xor alternatively, just trade using their original funds. Trade with tiny amounts to start with to become familiar with the BitMEX site. A hidden order pays the taker fee until the entire hidden quantity is completely executed.

Privacy Policy. It is possible that you will never ever pay any trade fee at Bitmex. Sign in Get started. Illustrative example of an insurance contribution — Long x with 1 BTC collateral. The order book shows three columns — the bid value for the underlying asset, the quantity of the order, and the total USD value of all orders, both short and long. Your order is not placed until you confirm Buy in this screen. If XBT drops to this liquidation price, your position will be closed at a loss. Think How Bitmex gives X times Bitcoin to the traders. From there on, the UI is quite intuitive, provided you are well versed with the margin and derivate trading lingo. Here are the major fees on the BitMEX platform. And always use a two-legged trade: Ignore the data in the Your Position box for a trade I took before taking the screenshot. Illustrative example of an insurance depletion — Long x with 1 BTC collateral. On BTC, you can get leveraged maximum x on spot and futures , both when going long and going short. The bid and offer prices represent the state of the order book at the time of liquidation.

The Latest

From names to addresses, to government identification details, taxpayer identification number and a lot more; and Exchanges handle of course a lot of cash or coin deposits and withdrawals. From our perspective, the trading view makes sense. Wednesday, May 22, It is how it must be: Execution only by limit order or immediately cancelled — and finally never executed by market order. You have to constantly consider what is more cost effective for you. Please share this article with your network if you find it useful! Read this information very carefully — and pay close attention to the liquidation price. There is no iOS app available at present. Bankruptcy Price Gap Means you Lose. Well, I have been there. It is possible that you will never ever pay any trade fee at Bitmex. BitMEX is a derivative market for crypto instruments. But since the exchange has no official oversight, it is not obliged to conduct anything of the sort. Do not try to day trade on this exchange with tight losses. I guess the writer did not use the platform…. Sounds good? Where do you trade or margin trade cryptocurrencies? What is cost of using leverage? In essence, the Binary series contracts are a more complicated way of making a bet on a given event.

Here is the fee break-up for the. There are tabs where users can select their Active Orders, see the Stops that are in place, check the Orders Filled total cryptocurrency iota bitcoin minimum transaction size partially and the trade history. And BAM! It quickly becomes apparent why leverage trading has become so attractive to cryptocurrency traders on BitMEXas the gains can be astronomical in proportion to a traders capital. During these periods, traders may be unable to place a trade or close out a position before getting liquidated. Close Menu Sign up for our newsletter to start getting your news fix. More accurately, commodity and foreign exchange derivatives fall under the oversight of the CTFC while derivatives that reference securities fall under the SEC. I will not add to the list of complaints on how they use their customized liquidation mycelium bitcoin wallet ios coinbase sell to blow off your account regularly… Yes, this is a scam…!! Never miss a story from Hacker Noonwhen you sign up for Medium.

BitMEX Review: High Leverage Bitcoin & Altcoin Trading, Safe or Not?

There are no limits on withdrawals, but withdrawals can also be in Bitcoin. We have been notified. Slow and Steady View Article. The greater the leverage the smaller the adverse change in price that will cause a Liquidation. It also has a built in feature that provides for TradingView charting. Enter your email address to subscribe to this blog and receive notifications of new posts by email. Those fees are applied to the total value of a position, not the principal. Still, if Hayes wants to grow his business, he may have a few challenges to reckon. A market maker is an individual or a firm that stands by every arihant jain cmu bitcoin id card coinbase of the trading bitmex fees why bitcoin is great ready to buy bid and sell ask orders immediately, usually with the help of bots. And opening and closing a contract counts as two trades, not one. Upon completion of registration and login, you will see this dashboard page. What is cost of what to look at when investing in a cryptocurrency could bitcoin be overtake by other leverage? Bitmex commissions are not related with leverage but with quantity. The greater the leverage, the smaller the loss. Users also see all currently open positions, with an analysis if it is in the black or red. If you try again. Perpetual contract fees:. The site calculates your Position size from a Risk Amount how much you are prepared to loseb distance to Stop, and c Entry Price.

A marker-maker is defined as someone who places a Limit order and does not take the market price to open or close a trade. An archipelago in the Indian Ocean, Seychelles is notoriously light on corporate regulation and does not require companies to pay taxes or undergo audits. Now it is time to hear from you: BitMEX allows its traders to leverage their position on the platform. After hitting an all-time time high in December , bitcoin has been steadily dropping in price. OK, you have read this far and you understand the trading fees of this exchange. The illustration is an oversimplification and ignores factors such as fees and other adjustments. Read our full Bitmex plaform guide with a lot of examples. Here, liquidations manifest as contributions to the insurance fund e. On BitMEX, users can leverage up to x on certain contracts. In a presentation over the summer, Hayes spoke on how KYC slows down the process of opening an account on an exchange.

Funding methods

The above tables also show that even with the minimum 1x Leverage there is a small but real risk of Liquidation when Long. An archipelago in the Indian Ocean, Seychelles is notoriously light on corporate regulation and does not require companies to pay taxes or undergo audits. BitMEX has a sophisticated margin and liquidation process which prevents a users margin from dropping below their account balance. Accept Read More. They have a negative fee for makers. Low trading fees are indeed very important for any prospective cryptocurrency investor. So if you make a maker order worth USD , which is picked up by a taker, you get paid USD 25 for providing the liquidity. We will talk about the types of contracts further in this article. NEWS 31 March Withdrawal fees correspond to the network fees approx. More adventurous traders should note that while the insurance fund holds 21, Bitcoin, worth approximately 0. As above, misleading is that this amount you will see in your trade history as: This is basic and extremely important. I started CoinSutra to help users around the globe to learn about popular Cryptocurrencies. To help solve this problem, BitMEX has developed an insurance fund system, and when a trader has an open leveraged position, their position is forcefully closed or liquidated when their maintenance margin is too low. That is a trade for suckers. Archos Safe-T Mini:

This is the maximum you can lose. This is how much you have available for trading. Therefore, traders trading with x leverage in this example would make profits equivalent to those if they held BTC, as opposed to just 1 BTC. However, it is recommended that users use it on the desktop if possible. With the maximum x leverage the loss is 0. BitMEX specialises in sophisticated financial operations such as margin trading, which is trading with leverage. Well, Restore bitcoin wallet electrum kingdom ministries bitcoin have been. Typically, anyone can trade both sides of a contract. Blocking IPs is not foolproof. Before reading the below information it can be worth clarifying the following: Howdy, Welcome to the popular cryptocurrency blog CoinSutra. Ted March 31, at Once users have signed up to the platformthey should click on Trade, and all the trading instruments will be displayed beneath. These tables shows the leverage level and the adverse change in bitcoin fork bch date can i use coinbase as a wallet that will result in Liquidation. Run by bitmex fees why bitcoin is great staff of more thanBitMEX touts itself as the most liquid bitcoin derivatives exchange in the world.

Rush or no rush is always good explain of you order choise. However, minergate iphone cryptocurrency chargeback is not for the can mac mine bitcoin price trump elected. The above tables show that Jaxx wallet vs mycelium bch electrum is safer than going Long, in that a larger percentage change and USD change is required to cause Liquidation when you go Short than when you go Long, for a given level of Leverage. Howdy, Welcome to the popular cryptocurrency blog CoinSutra. He landed a job at Deutsche Bank in Hong Kong, where he made markets for dash to coinbase how to sell bitcoin bittrex funds. Advanced traders are fully aware of these. So today I have decided to review BitMEX exchange in an unbiased manner and tell you everything about it that matters. So, having reviewed the major features of the BitMEX exchangeshould users trust their funds on this exchange, and should they trade there? To prevent U. These contracts are called derivatives. However, when withdrawing Bitcoin, the minimum Network fee is based on blockchain load. Totally agree with Pat. Isolated and Cross-Margin. For those interested in learning more about Coinbase, please read our in-depth Coinbase Review.

The exchange offers margin trading in all of the cryptocurrencies displayed on the website. This removes the possibility of getting Liquidated, which is highly costly. There would appear to be few complaints online about BitMEX, with most issues relating to technical matters or about the complexities of using the website. BitMEX operates multi-signature deposit and withdrawal methods, which means that every single address associated with a BitMEX account is multi-sig, and funds are kept offline. Instead, traders are buying contracts for that asset, settled in the future. The majority of funds kept on BitMEX are kept in cold storage, and private keys are never kept in cloud storage. More adventurous traders should note that while the insurance fund holds 21, Bitcoin, worth approximately 0. BitMEX only charges the network fee when making withdrawals. This website uses cookies to improve your experience. New entrants to the sector should spend a considerable amount of time learning about margin trading and testing out strategies before considering whether to open a live account. Fees are calculated on this amount. BitMEX fees for market trades are 0. Pat March 9, at 1:

However, it is not for the beginner. Eventually, she got fascinated by the crypto industry and started writing for Forbes and CoinDesk. Therefore, it is best left to experienced traders who understand it. It also offers to trade with futures and derivatives — swaps. I traded TRX. Whilst it is impossible for users to lose more funds than what they opened a trade with their initial marginthey may find themselves subject to liquidation. Recommended BitMEX. It reduces Bitmex fees! Enter your email address to subscribe to this blog and receive notifications of new posts by email. Ignore the data in the Your Position box for a trade I took before taking the screenshot. Wednesday, May 22, Upon completion of registration and login, you will see this dashboard page. Also, as I said before, margin trading, especially in the cryptocurrency market can be highly risky. Fees are set as follows in those different groups:. The trading platform on BitMEX is very intuitive and easy to use for those familiar bytecoin wallet takes forever to fully download bitcoin us stock market similar markets. Here are the major fees on the BitMEX platform. Maker fee

The typical response time from the customer support team is about one hour, and feedback on the customer support generally suggest that the customer service responses are helpful and are not restricted to automated responses. But the only identification BitMEX requires of its traders is an email address. BitMEX has a sophisticated margin and liquidation process which prevents a users margin from dropping below their account balance. BitMEX does not charge fees on deposits or withdrawals. There would appear to be few complaints online about BitMEX, with most issues relating to technical matters or about the complexities of using the website. Funding methods Wire Transfer Cross. This works to stabilize the potential for returns as there is no guarantee that healthy market conditions can continue, especially during periods of heightened price volatility. BitMEX has one of the best security records of any trading platform in the crypto industry. I made hard copies of the screens but unfortunately i cannot post them here… So, if you are unlogged, you will get the following message when trying to connect: Additionally, they trade close to the underlying reference Index Price, unlike futures, which may diverge substantially from the Index Price. Bitmex is platform for gambler to betting market movement Reply. On the end quick explanation comapre: The maker-taker model encourages market liquidity by rewarding the makers of that liquidity with a fee discount. Well, I have been there. With standard futures contracts the Exchange will Margin Call the client for Maintenance Margin to supplement his Initial Margin when the price approaches the Bankruptcy Price, and you can lose a lot more than your Initial Margin. This may happen when there is inadequate liquidity on the peer-to-peer exchange to fill an order, despite the underlying asset falling below a users liquidation price. Here, you will find all the exact functions and features as you would on the real-time BitMEX exchange.

In the U. This helps to maintain a buzz around the exchange, and BitMEX also the coming bitcoin crash bitcoin block largest nonce relatively low trading fees, and is available round the world except to US inhabitants. Private keys are not stored on any cloud servers and deep cold storage is used for the majority of funds. Crucially, the insurance fund is used in periods of high and intense market volatility, where assets make rapid price swings and close out multiple traders positions, resulting in the exchange becoming backlogged. If you try again. It is not like they have never been part of any controversy. The most you can lose is your Margin. Partly pursuant to this, the BitMEX platform is extremely fast and reliable. Registration only requires an email address, the email address must be a genuine address as users will receive an email to confirm registration in order bitmex fees why bitcoin is great verify the account. Other Guides:. BitMEX also offers trading guides which nz cryptocurrency how crypto mining works be accessed. There are no trading fees on upside or downside contracts, and other than Bitcoin network fees, there is no charge for withdrawing or depositing from BitMEX. As your No. The following spring, Hayes showed up at Consensus, an annual cryptocurrency and blockchain conference in New York City, in an orange Lamborghini—a symbol of having made it big in the crypto world.

He landed a job at Deutsche Bank in Hong Kong, where he made markets for exchange-traded funds. Supported Crypto Contracts. But you paid. It also results in a tighter market spread due to the increased incentive for makers to outbid each other. That money came from salami-slicing the testicles of x bulls via the Liquidation Engine. These contracts are called derivatives. Theoretically you can wait even…years to get fulfilled. I made hard copies of the screens but unfortunately i cannot post them here…. It also has a built in feature that provides for TradingView charting. The above tables show that Shorting is safer than going Long, in that a larger percentage change and USD change is required to cause Liquidation when you go Short than when you go Long, for a given level of Leverage. It is possible that you will never ever pay any trade fee at Bitmex. Deposit addresses are externally verified to make sure that they contain matching keys.

Recently, the company hired regulatory expert Angelina Kwan to become its chief operating officer. This is quite a high level of leverage for cryptocurrencies, with the average offered by other exchanges rarely exceeding 1: The swap is similar to a futures contract, but with no altcoin mining pool software best btc mining hardware date. Deposit fees vary dependent upon how you deposit. Payment Methods 7. Instead, it settles every eight hours continuously, until you close your position. And opening and closing a contract counts as two trades, not one. T his is not so comfortable that is why you will get paid for your patience. Always check the trading fees!

The trading platform on BitMEX is very intuitive and easy to use for those familiar with similar markets. However, when withdrawing Bitcoin, the minimum Network fee is based on blockchain load. All Posts https: So, what does this mean, and how can traders open a long or short position on BitMEX? There are no limits on withdrawals, but withdrawals can also be in Bitcoin only. May 21, BitMEX generates high Bitcoin trading levels, and also attracts good levels of volume across other crypto-to-crypto transfers. The majority of funds kept on BitMEX are kept in cold storage, and private keys are never kept in cloud storage. Therefore, traders trading with x leverage in this example would make profits equivalent to those if they held BTC, as opposed to just 1 BTC. Run by a staff of more than , BitMEX touts itself as the most liquid bitcoin derivatives exchange in the world. He has extensive experience advising clients on Fintech, data privacy and intellectual property issues. You expect that Bitcoin price will explode in a few seconds.

The opinions expressed in this Site do not constitute investment advice and independent financial advice should be sought where appropriate. You have the diagrams in the middle, the history to the right, and the current order book to the left. A trading cryptocurrency guide must provide reviews of all of the top crypto exchanges out there, so that you can find the best cryptocurrency exchange site for you. Sign in Get started. This figure represents just 0. They have a negative fee for makers. Your email address will not be published. Auto-deleveraging means that if a position bankrupts without available liquidity, the positive side of the position deleverages, in order of profitability and leverage, the highest leveraged position first in queue.