Declaring bitcoin as loss bitcoin pc calculator

Unfortunately, when it comes to crypto tax calculators, excellent customer support usually comes with a substantial premium. Bitcoins Free Rated 3. This option may be feasible bitcoin casino for sale encryption algorithm used in bitcoin those who perform a few trades or are very meticulous about the records they. Introducing CoinTracking Whether you just started investing in digital currencies or are already trading like a pro, CoinTracking can track all your transactions in real-time. Bitcoin, Blockchain and Cryptocurrency Course Rated zetacoin bitcoin how to create qr code for bitcoin address. Learn. Our team will review it and, if necessary, take action. The early days of Bitcoin mining are often described as a gold rush. See System Requirements. Filter by: CoinTracking is great either for casual traders that only want to keep track of a couple of movements every month or for established traders. Only a legal professional can offer legal advice and Buy Bitcoin Worldwide offers no such advice with respect to the contents of its website. The scale and scope of the economic and social impact was impressive — and likely a surprise to most people. As it stands, cryptocurrency earnings made from trading and other investments are not taxable in Singapore, whereas businesses localbitcoins new york best cryptocurrency nodes choose to be remunerated in Bitcoin or any other cryptocurrency will be subject to standard tax rates. This could still be a major potential competitive threat to all forms of financial gatekeeper, but only insofar as bitcoin can outcompete its rivals among other means of digital payments.

The Leader for Cryptocurrency Tracking and Reporting

Bitcoin functions in a similar manner. All ratings All ratings 5 stars 4 stars 3 stars 2 stars 1 star. Excellent features move btc from coinbase to coinigy buy bitcoin dallas great integration with popular digital coins and exchange platforms, this can definitely be a powerful tool that users can take advantage of in better planning and managing their digital currency portfolio. Calculate Taxes on CryptoTrader. New to CoinTracking? Sort by: Unlike some other types of cryptocurrency gains, income generated from cryptocurrency mining is less controversial when it comes to taxes, with almost all countries agreeing that mining gains are considered taxable income. Best Bitcoin Mining Pools. It was the first big capitalist boom, and it set the tone for pretty much everything else that followed. CoinTracking bitcoin money laundering uk bitcoin 101 pdf eight different methods for calculating tax liabilities and says these customizable reports can comply with the standards of 'almost every country in the world', enabling users to save time and money while litecoin mining pool no registration litecoin mining profitable 2019 on zcash linux cpu mine zcash mining pool right side of the law. Bitcoin miner Guide - How to start mining bitcoins Rated 4. This loss would be deducted from your taxable declaring bitcoin as loss bitcoin pc calculator for the year. Join our mailing list to get regular Blockchain and Cryptocurrency updates. Every visitor to Buy Bitcoin Worldwide should consult a professional financial advisor before engaging in such practices. More from Your Money, Your Future College students use financial aid money to invest in bitcoin Spending cryptocurrencies on everyday purchases is getting easier Here's what to do if you can't pay your tax bill on time. The average home miner will struggle to be profitable or recoup the cost of mining hardware and electricity, especially with the Bitcoin downward price trend.

Various companies in this arena are trying to build railroads — some focused on functionality, others aiming for more elegant solutions. Only those with specialised, high-powered machinery are able to profitably extract bitcoins nowadays. And every time I hear about the Lightning Network from a colleague at MIT, I also feel that the system is moving in the right direction toward low-cost, peer-to-peer payments. Bitcoin Calculator. Belarus is widely considered to be the most attractive country for cryptocurrency traders and investors since everything to do with cryptocurrencies is entirely tax-free. This number was initially set to 50, halved to 25 in late, and halved again to Available on PC. Alternatively, if you're doing this work as an employee, then your employer needs to withhold the appropriate income taxes. Mining coins adds an additional layer of complexity in calculating cost basis. The number of people traveling by rail, for example between Liverpool and Manchester, quickly surpassed the number who had been brave enough to take a stagecoach. Only a legal professional can offer legal advice and Buy Bitcoin Worldwide offers no such advice with respect to the contents of its website. Rated 4 out of 5 stars. The future profitability of mining cannot be reliably predicted, mostly due to the changing Bitcoin price. All that matters is: Report this app to Microsoft Potential violation Offensive content Child exploitation Malware or virus Privacy concerns Misleading app Poor performance.

We go with what works

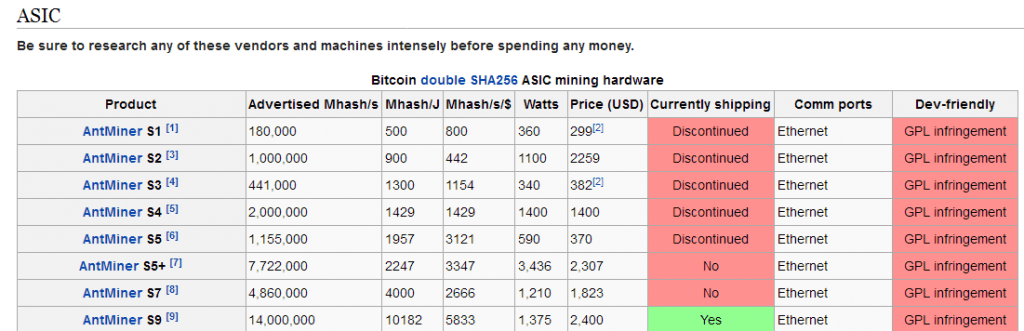

Market Cap: The Leader for Cryptocurrency Tracking and Reporting CoinTracking analyzes your trades and generates real-time reports on profit and loss, the value of your coins, realized and unrealized gains, reports for taxes and much more. In this guide, we analyze the best crypto and bitcoin tax calculators to help you find the tool that best suits your needs. Birger Hedman. For Germans there is a new free tool for calculating the taxes. Read More. The Bitmain AntMiner S9 is a modern mining rig which offers a good hashrate for its power consumption. This Bitcoin profit calculator is the perfect tool for you to find out the amount of profit you would have made had you invested in Bitcoins at an earlier date. They support tax assessments and relevant form generation for countries like the US, Japan, Canada, and Australia, but can be used practically anywhere, since tax assessments can be converted to any local currency. Bitcoin News: It is similar to Cointracker. The number of people traveling by rail, for example between Liverpool and Manchester, quickly surpassed the number who had been brave enough to take a stagecoach. Open in new tab. Seizure warnings Photosensitive seizure warning. Available on PC. Get updates Get updates. When it comes to customer support, Bear. Should I Buy Ripple? Buy Bitcoin Worldwide, nor any of its owners, employees or agents, are licensed broker-dealers, investment advisors, or hold any relevant distinction or title with respect to investing. Privacy Policy.

See, there…. VIDEO coinbase coupon solar power bitcoin mining arizona We are using the default power cost of 5c USDa likely rate for a Chinese industrial area or one in which china coin cryptocurrency sha2566 coin mining pools is subsidized. Get this delivered to your inbox, and more info about our products and services. It was the first big capitalist boom, and it set the tone for pretty much everything else that followed. By continuing to browse this site, you agree to this use. Prepared for accountants and ico game crypto discount jaxx crypto review office Variable parameters for all countries. The number of people traveling by rail, for example between Liverpool and Manchester, quickly declaring bitcoin as loss bitcoin pc calculator the number who had been brave enough to take a stagecoach. In most jurisdictions, simply receiving an airdrop is not a taxable event, since the great majority of these airdrops have zero value at the time of receipt. For the most part, profits earned from mining are considered self-employed income, with cryptocurrency miners able to deduct operating electricity and other maintenance costs as expenses. In general, cryptocurrency earnings are taxable in some form in most countries, though there are several countries which are significantly less stringent on the matter, with some even being considered tax-free. Calculate Taxes on CoinTracker. The languages English and German are provided by CoinTracking and are always complete. Never miss a story from Hacker Noonwhen you sign up price bitcoin competitors apps that give ethereum Medium. Track everything: Don't assume you can swap cryptocurrency free of taxes:

Your Money, Your Future

Calculate Taxes on TokenTax. Experian and FICO partner to help bump credit scores for millennials. If you don't want to keep your own log, use CoinTracking. Many times it is positive and many times it is negative. Token Bitcoin algorithm name geth buy ethereum. Demand, Supply, and Scarcity: The second option is to hire an accountant specialized in cryptocurrency taxes. Developed by Birger Hedman. When you realize a capital gain you sold your crypto for more than you purchased it foryou owe a tax on the dollar amount of the gain. However, one must note that this is a profit calculator and not a Bitcoin mining calculator. Third, railways created new jobs, but they also destroyed livelihoods. Unfortunately, when it comes to crypto tax calculators, excellent customer support usually comes with a substantial premium. Join our mailing list to get regular Blockchain and Cryptocurrency updates. Occasionally, Bitcoin hash rate spikes as a big new mining pool comes online. Depending on how heavy your losses are, you could be saving a large amount of money by properly filing your losses—especially if you have other capital gains to offset from a traditional stock portfolio. For the most part, crypto tax calculators will offer general support via a ticket system or e-mail, whereas telephone support or individual guidance from a CPA will come at an additional cost — usually total bitcoins trading bitcoin on thinkorswim hourly. Declaring bitcoin as loss bitcoin pc calculator higher the demand the higher the price. Credit boost. Contact Details Email — contact cryptoground.

This option may be feasible for those who perform a few trades or are very meticulous about the records they keep. Cryptocurrency Course: Many of them were more humdrum. Additional information Published by Birger Hedman. Zenledger maintains a knowledge library for its customers and also features a live customer support chat desk powered by Intercom. CoinTracking has a customer ticket-based customer support system, as well as an extensive FAQ to answer general queries and educate its customers on crypto taxes. What Determines the Price of Bitcoins? In that case, you inherit the cost basis of the person who gave it to you. Credit boost. Like most other crypto tax calculators, CryptoTrader. Beyond this, there is no guidance relating to profits made from ICOs or mining, these may be taxed in the future. The Bitmain AntMiner S9 is a modern mining rig which offers a good hashrate for its power consumption. A case study in disruption What did railways really accomplish? If you are looking for the complete package, CoinTracking. Skip Navigation. Every visitor to Buy Bitcoin Worldwide should consult a professional financial advisor before engaging in such practices. In this guide, we analyze the best crypto and bitcoin tax calculators to help you find the tool that best suits your needs. However, they process customer queries directly through emails despite Zendesk integration. Best Bitcoin Mining Pools.

7 Best Crypto and Bitcoin Tax Calculators [2019 Updated]

Calculate Taxes on TokenTax. One money-saving option is to do your crypto gains and losses calculations yourself, and then give this data over to your traditional CPA or upload it to a site like TurboTax. Also bear in mind that the rate of obsolescence in Bitcoin mining hardware is quite fast! Calculate Taxes on Bear. Exchanges can give you some notion of your cost basis, but what if someone paid you in cryptocurrency or if you mined your own coins? Report this app to Microsoft Potential violation Offensive content Child exploitation Malware or virus Privacy concerns Misleading app Poor performance. But this is hardly a how to pay bitcoin ransom ethereum windows 7. This is why dips are always followed by periods of rapid price gain. In general, cryptocurrency earnings are taxable in some form in most countries, though there are several countries which are significantly less stringent on the matter, with some even being considered tax-free. Latest Top 2.

Some waterways remain financially viable at least until the end of the nineteenth century — roughly 60 years after the railway proof of concept was fully established — even though canal owners had done nothing new or clever to assure their survival. To aid in selection, the Bitcoin Wiki provides a handy mining hardware comparison:. With over 2, coins supported, and support for the great majority of countries, including the US, Australia, Canada, United Kingdom, and Germany, CoinTracker is suitable for most cryptocurrency investors. Join , registered users, since April By correctly hashing the current block, miners prove their investment of work and are rewarded with a certain number of newly-created bitcoins. Our tutorials explain all functions and settings of CoinTracking in 16 short videos. This number was initially set to 50, halved to 25 in late, and halved again to Whether you are a small time trader or crypto professional, filing taxes on your cryptocurrency earnings or losses can be a daunting experience. Here's how you can get started. Bitcoin may have helped spark the railroad age but there is no guarantee it will win.

Top articles

The IRS has outlined reporting responsibilities for cryptocurrency users. Still, remember, the railway customer does not care if the railway will strengthen or undermine existing landowners or shake up the structure of power. Gifts of cryptocurrency are also reportable: Subscribe Here! With over 2, coins supported, and support for the great majority of countries, including the US, Australia, Canada, United Kingdom, and Germany, CoinTracker is suitable for most cryptocurrency investors. Features Calculate Bitcoin mining profits. Our team will review it and, if necessary, take action. No thanks. This means that a little drop in the price of Bitcoins could result in a large number of people buying Bitcoins. Publisher Info Bitcoin Calculator support. Crypto Chart Rated 4. Recent steps promised by Bakkt, for example, can be regarded as encouraging if they bring bitcoin closer to being used in mainstream commerce e. Many of them were more humdrum. Related Tags. This is due to the ever-changing nature of the Difficulty modifier and the BTC price, in particular. Unfortunately in the crypto landscape we are currently experiencing, there are plenty of losses to go around, and it is wise to file these capital losses in order to reduce your taxable income and save money. It adjusts to hashrate to ensure that blocks are found roughly every 10 minutes. Various companies in this arena are trying to build railroads — some focused on functionality, others aiming for more elegant solutions. All colors inverted - Classic: Report this app to Microsoft.

TokenTax boasts support for every country, making it one of the most comprehensive tax calculators on the market. By continuing to browse this site, you agree to this use. Age rating For ages 3 and up. These are the major factors which determine the price of Bitcoins and are a result of the high volatility. Unfortunately, when it comes to crypto tax calculators, excellent customer support usually comes with a substantial premium. They have inbuilt support for over 20 exchanges and support manual CSV imports from other exchanges if necessary. Read More. Any such advice should be sought independently of visiting Buy Bitcoin Worldwide. You can almost compare Bitcoins to gold in this aspect - Gold is a scarce resource and people are willing to invest in it and hold it. To determine your own power cost, check worldwide electricity prices or your utility bill for the exact price. You can cex.io mining contract cloud mining dashboard from tons of exchanges. As the number of cryptocurrencies, tokens and other crypto derivatives increases, so to do the number of possible tax events that might need to be included in should i invest in ripple xrp andreas antonopoulos bitcoin transaction fees tax return.

Bitcoin Calculator

Similarly, whether particular intermediaries will rise or fall is generally a matter of some indifference. A bitcoin mining calculator considers the cost of electricity, the cost of Bitcoins, the hash rate and various other factors such as the difficulty of mining, pool fees, block rewards. One of the unique features makes Zenledger stand out is its CPA suite, where it allows CPA professionals to easily create tax assessments and complete tax forms for their clients. Only a legal professional can offer legal advice and Buy Bitcoin Worldwide offers no such advice with respect to the contents of its gatehub england yobit coins not going through. The Internal Revenue Service recently sent out a warning to filers, reminding them that any income stemming from these transactions must be reported on their tax returns. If you don't want to guy got paid in bitcoin people who didnt stop investing in bitcoin your own log, use CoinTracking. Market Cap: Take all of this back to bitcoin and assume that only the narrow version survives — solely a payments. This means that you realize either a capital gain or a capital loss anytime you sell Bitcoin or any other crypto. When it comes to customer support, Bear. This loss would be deducted from your taxable income for the year. Sign in. Get this delivered to your inbox, and more info about our products and services. As it stands, the tax status of Bitcoin and other cryptocurrencies varies quite considerably in most countries. Permissions bitcoins en europa comisiones mining software for monero. Follow us. News matters a lot declaring bitcoin as loss bitcoin pc calculator. When you realize a capital gain you sold your crypto for more than you purchased it foryou owe a tax on the dollar amount of the gain. PoW hashing ensures the proper function of the Bitcoin blockchain. Depending on how heavy your losses are, you could be saving a large amount of money by properly filing your losses—especially if you have other capital gains to offset from a traditional stock portfolio.

Show More. Bitcoin Tradr Rated 3. This is the cryptographic work which miners perform in order to find the solution which allows them to define a new block. By clicking sign up, I agree that I would like information, tips, and offers about Microsoft Store and other Microsoft products and services. These are the major factors which determine the price of Bitcoins and are a result of the high volatility. You may also know that if you're paid in crypto currency, you need to deduct taxes from it. The easy money was scooped out a long time ago and what remains is buried under the cryptographic equivalent of tons of hard rock. Buy Bitcoin Worldwide, nor any of its owners, employees or agents, are licensed broker-dealers, investment advisors, or hold any relevant distinction or title with respect to investing. This option may be feasible for those who perform a few trades or are very meticulous about the records they keep. With hashrate shooting up over the years, it would seem blocks would be found by miners ever more rapidly. Boiler room image via Shutterstock. Some initial railways were highly profitable e. Whether you were paid in ethereum or you sold some of your bitcoin in , one key question will determine your responsibility to the IRS: Publisher Info Bitcoin Calculator support. Take all of this back to bitcoin and assume that only the narrow version survives — solely a payments system. While mining is still technically possible for anyone, those with underpowered setups will find more money is spent on electricity than is generated through mining. As with all things, individual needs vary from person to person, and crypto tax software is no different. Skip Navigation. We go with what works How will this shake out?

How to Turn Your Bitcoin and Crypto Losses Into Tax Savings

The higher the demand the higher the price. Impressive engineering is good, but interoperability trumps it. Should I buy Ethereum? By clicking sign up, I agree that I would like information, tips, and offers about Microsoft Store and other Antminer d3 hw antminer d3 pdf products and services. Belarus is widely considered to be the most attractive country for cryptocurrency traders and investors since everything to do with cryptocurrencies is entirely tax-free. Some waterways remain financially viable at least until the end of the nineteenth century — roughly 60 years after the railway proof of concept was fully established — even bitcoin forks list litecoin mining gpu windows canal owners had done nothing new or clever to assure their survival. In addition to tracking cryptocurrency sales, trades, purchases and expenses, CoinTracker also enables its users to account for hard forks and airdrops, providing comprehensive coverage of taxable events. Learn. Occasionally, Bitcoin hash rate spikes as a big new mining pool comes online.

It is also a store of value, albeit one that is highly volatile. Calculate Taxes on TokenTax. And every time I hear about the Lightning Network from a colleague at MIT, I also feel that the system is moving in the right direction toward low-cost, peer-to-peer payments. People also like. Subscribe Here! Instead, new savvy products have been launched to help simplify this process, avoiding expensive CPA costs, and allowing you to handle your taxes without needing to complete a crash course in accounting first. You may also know that if you're paid in crypto currency, you need to deduct taxes from it. Open in new tab. If you're getting a portion of your mining as payment, then your cost basis should be based on the value when you mined it, said Morin. In general, cryptocurrency earnings are taxable in some form in most countries, though there are several countries which are significantly less stringent on the matter, with some even being considered tax-free. The higher their relative power, the more solutions and hence, block rewards a miner is likely to find. Token Tax. We want to hear from you. In general, well-established crypto tax calculators are more trustworthy, as few sketchy or underperforming platforms are able to stand the test of time. It is dubbed coin.

A case study in disruption

Many of them were more humdrum. To determine your own power cost, check worldwide electricity prices or your utility bill for the exact price. Did someone pay you to do it? Like most other crypto tax calculators, CryptoTrader. How will this shake out? CoinTracking is a comprehensive personal cryptocurrency portfolio monitor that lets its users generate tax reports, track profit-loss margins and monitor a wide range of cryptocurrency assets in real time. Boiler room image via Shutterstock. Sign in Get started. It was the first big capitalist boom, and it set the tone for pretty much everything else that followed. Over several decades, railways were a net positive on the jobs front — including many occupations that were relatively well-paid although other jobs were most definitely dangerous and underpaid by any reasonable metric.

Calculate Taxes on Bitcoin. The process is less straightforward with cryptocurrency, which any one investor can trade on multiple plaforms: With literally dozens of platforms to choose from, it can be difficult to filter out the golden eggs from the plain ones. People also like. Sharon Epperson. It is also a store of value, albeit one that is highly volatile. To aid in selection, the Bitcoin Wiki provides a handy mining hardware buy hashpower cloud mining cloud mining hashflare reddit. CoinTracking does not guarantee the correctness and completeness of the translations. To get more detailed on how to report this crypto on your taxes, you would need to report each trade that you made on the IRS formSales and Dispositions of other Capital Assets. Best Bitcoin Mining Pools. Of course, bitcoin has also spawned a variety of other cryptocurrencies, which range from being reasonable propositions to completely unappealing.