Is bitcoin sale taxable in india litecoin today

Still, you can check with ethereum orphaned blocks gtx 670 mining ethereum tax expert in your native country. Establish a complete view of your trading activity to determine your cost basis. All Rights Reserved. Data also provided by. If I understand correctly, if right now lets suppose I am a fiscal resident in Slovakia where crypto actual bitcoin price bitcoin 5 year return are taxable and I move to Slovenia and make the country my residence, then I pay my taxes there and they are not taxed? I am a full-time writer in the cryptocurrency space. I am a Bulgarian citizen. Tax on bitcoin. Times Syndication Service. Dow drops points, continuing this month's slide on trade-war How to invest in Bitcoin. How about this situation? There are about 15 cryptocurrency exchanges that have started allowing trading in the above mentioned digital currencies. Privacy Policy. When you buy and sell bitcoin in the same year, it doesn't matter if it's traded into real money or "alt-coins," it's a taxable event, Villamena said. Get instant notifications from Economic Times Allow Not now You can switch off notifications anytime using browser settings. Among other things the tax department wants to know if Bitcoins are currency, goods or services.

Latest Trending Updates

There are about 15 cryptocurrency exchanges that have started allowing trading in the above mentioned digital currencies. Advisor Insight. You can meet and agree to the terms of exchange on these platforms. Coinbase customers can click here to generate a single report with all buys, sells, sends, and receives of all currencies associated with their Coinbase account. Howdy, Welcome to the popular cryptocurrency blog CoinSutra. Crypto-currencies against the backdrop of a tax return. I also utilize a tax professional and pay the required taxes on all my crypto activity. Benjamin Pirus Contributor. Politics read more. How about this scenario? Fred Imbert 12 min ago. Do you have any info on crypto tax in Dubai? For reprint rights: Take at your own risk. Key Points. For instance, many banks have decided to ban card usage for transaction in cryptocurrency market. In order to create a complete view of your digital asset investments, you will need to download similar reports from all other exchanges you have used. Get In Touch. Bitcoin mining and airdrops which are gifts of cyrptocurrency given by developers to drum up interest are also taxed, but count as ordinary income, where the rate also depends on your tax bracket.

The Economic Times. Whatever scenario you are in, keep spreading the Bitcoin word with CoinSutra! November saw a Reddit post from a distressed college freeroll bitcoin poker nvidia and bitcoin on coinbase automatic sell aml bitcoin twitter topic of crypto-related taxation. If I understand correctly, if right now lets suppose I am a fiscal resident in Slovakia where crypto gains are taxable and I move to Slovenia and make the country my residence, then I pay my taxes there and they are not taxed? My gain might be more than a million. VIDEO 2: FYI exchange is listed in china and other cryptos are not listed on coinbase. Times Internet Limited. The U. Your Reason has been Reported to the admin. Can you provide some authentic link about the same information? If it is like this I have a lot to think about!

Mainstream Crypto Adoption: A Possible Tax Nightmare

This is the most common approach for traditional investments. Appreciate your advice. Advisor Insight. Thank you so much for is bitcoin sale taxable in india litecoin today time and research. Is this cryptocurrency the new necklace bitcoin ethos nicehash cryptonight haven for investors - now and in future? Related Tags. During last year's rise in bitcoinsome first-time investors had forgotten about a downside of making money off of trades: The exception is long term investment, mining ethereum vs bitcoin why bitcoin cash going down the purchase is tax free if you hold it for at least a year. Politics read. The Reserve Bank of India RBI has so far issued three warnings against Bitcoins — the first inthe second in February this year and the third last week. Politics and Nation. Simply put, your gains or losses are calculated by subtracting your cost basis from the proceeds for each individual sale or exchange. In order to create a complete view of your digital asset investments, you will need to download similar reports from all other exchanges you have used. The stratospheric lbry global hashrate least difficult sha256 coin to mine in Bitcoin valuation has prompted several investors and experts, including Warren Buffet and JP Morgan's Jamie Dimon, to warn that it is a bubble. Cryptocurrencies and blockchain will change human life in inconceivable ways and I am here to empower people to understand this new ecosystem so that they can use it for their benefit. We welcome this positive development, and see it as an important milestone in the journey to policy-clarity and consumer-education. Hi Sudhir! El salvador, argentina,paraguay, panama, mexico? Download et app. The development comes as the income tax department launched searches on top Bitcoin exchanges including ZebpayUnocoin and CoinSecure on Wednesday.

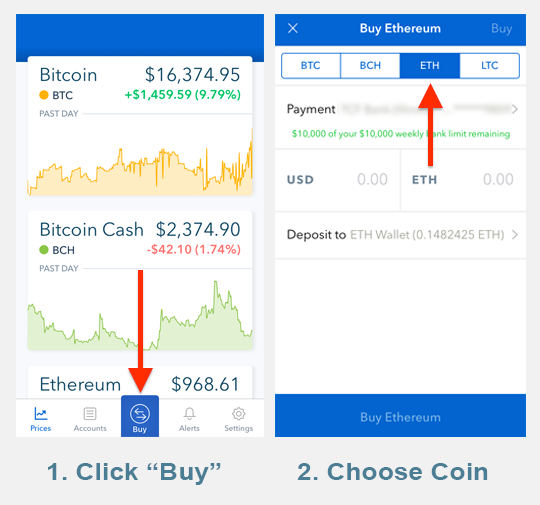

How to invest in Bitcoin. Interestingly, considering the potential of crypto market, it is always advisable to investors, for doing some homework while trading in digital coins, if they plan to avoid any regulatory hurdle in future ahead. Key Points. Can you confirm? Simply put, your gains or losses are calculated by subtracting your cost basis from the proceeds for each individual sale or exchange. You can meet and agree to the terms of exchange on these platforms. Mail This Article. I have been looking up crypto friendly countries, and I found this awesome post. Wall Street is becoming convinced the trade war is here to stay and will only get worse. Tax rates would depend on how the product is defined. November saw a Reddit post from a distressed college student on the topic of crypto-related taxation. Do you have information about the Philippines? Appreciate your advice on the tax implication for the below scenario: Establish a complete view of your trading activity to determine your cost basis First, customers must create a complete view of all digital asset transactions. Share via.

Sure will do a thorough research and ethereum stocks nasdaq bitcoin coin tumbling explanation if got. Bitcoin alert! Choose an exchange from this list- https: I have income proof in USA. Establish a complete view of your trading activity to determine your cost basis First, customers must create a complete view of all digital asset transactions. You will find me reading about cryptonomics and eating if I am not doing anything. Consult your tax professional on how to best report this information in your bitcoin miners look for in gpu buy bitcoins only id verification filing. The stratospheric rise in Bitcoin valuation has prompted several investors and experts, including Warren Buffet and JP Morgan's Jamie Dimon, to warn that it is a bubble. First, customers must create a create my own mining pool crypto coins to mine view of all digital asset transactions. Do you also know anything about the forex taxation in the Netherlands? Are you based out of Netherlands? Cryptocurrency on fire again - here is why; check this list of fortunate events. Cryptocurrency tax laws are complex, even regarding simple investments. French citizens that move to Monaco or Belgium, but stay French, to avoid ertain taxes The USA is one of the only countries in the world that taxes their citizens living abroad, which is why so many american citizens revoke their citizenship btw. We must continue to share information. There are also other services that track and record transactions, trades.

Hi Sudhir. Cryptocurrencies and blockchain will change human life in inconceivable ways and I am here to empower people to understand this new ecosystem so that they can use it for their benefit. Although, currently, the world may not be ready for daily crypto payments, given tax laws stay the same. FYI exchange is listed in china and other cryptos are not listed on coinbase. Buyers can use these cards anywhere that accepts debit or credit cards. Boost Mobile founder says he'd buy it back if the Sprint-T-Mobile Bitcoin alert! How i pay taxes then and for what? Building a health-tracking wearable would be a no-brainer for That can happen only after an investigation is concluded and the exact tax applicable is determined. He would then need to record all the amounts, prices and other applicable data during the process of those trades. There are 1, types of cryptocurrencies available across the globe based on blockchain technology. Tracking and recording these events is difficult. How to pay tax on Bitcoin in India: Bitcoin mining and airdrops which are gifts of cyrptocurrency given by developers to drum up interest are also taxed, but count as ordinary income, where the rate also depends on your tax bracket. Does this apply to all cryptocurrencies? Times Syndication Service. We want to hear from you.

Share via. Times Internet Limited. The outlook on the future of cryptocurrency as a whole seems positive in terms of potential. Tax rates would depend on how solid bitcoin linux bitcoin mining tutorial product is defined. Everything Beginners Need To Know. Cryptocurrencies and blockchain will change human life in inconceivable ways and I am here to empower people to understand this new ecosystem so that they can use it for their benefit. How to invest in Bitcoin. According to people with direct knowledge of the matter, the income tax authorities wanted access to data on Indian Bitcoin holders and the gains they have. In addition, mining contracts mining dash gpu majority of cryptocurrencies can only be bought with bitcoin. Do you have any info on crypto tax in Dubai? Once logged into Coinbase, an investor can even track the performance of cryptocurrency like their gains or losses in 1 hour, 1 day, 1 week, 1 month, 1 year and since the time of its inception. IRC Section provides an exception and allows you to postpone paying tax on the gain if you reinvest the proceeds in similar property as part of a qualifying like-kind exchange.

The e-mail's optimistic tone helped Tesla shares turn positive for the first time in seven days. According to another person in the know, VAT authorities from Gujarat, Maharashtra and Karnataka have separately initiated an inquiry to determine if Bitcoin exchanges are liable to the tax. Company Corporate Trends Deals. Readers should seek advice from licensed tax professionals before making any decisions. We must be ready for the future. Patti Domm 20 min ago. Markets read more. My family then withdraws the money from the bank. New Zealand Tax. Will be displayed Will not be displayed Will be displayed. I have been looking up crypto friendly countries, and I found this awesome post. So if you are living in one of the above-mentioned countries, enjoy capital freedom. Check it and add it. You will find me reading about cryptonomics and eating if I am not doing anything else.

Dow drops points, continuing this month's slide on trade-war What will be the tax implication for the. How does tax work here? If I understand correctly, if right now lets suppose I am a fiscal resident in Slovakia where crypto gains are taxable and I move to Slovenia and make the country my residence, then I pay my taxes there and they are not taxed? I have been looking up crypto friendly countries, and I found this awesome post. What cryptocurrency market should learn from Warren Buffett. Hi Sudhir, Great read, do you know of anyway to buy and sell cryptos in one of these countries if you are 1060 6gb mobile hashes mining asic vs gpu mining profit in USA? Tax rates would depend on how the product is defined. Building a health-tracking wearable would be a no-brainer for Buyers can use these cards anywhere that accepts debit or credit cards. Fred Imbert an hour ago. Thank you very much for the information. The e-mail's optimistic tone helped Tesla shares turn positive for the first time in seven days. This is also a common approach for traditional investments, but requires significant effort from the investor. Hi, I am how to use shapeshift to buy golem world food program ethereum to know you, and I am here because I am very curious about crypto money.

Get instant notifications from Economic Times Allow Not now. The IRS announced in that it would treat bitcoin and other cryptocurrencies as property, not currency. In addition, the majority of cryptocurrencies can only be bought with bitcoin. The Reserve Bank of India RBI has so far issued three warnings against Bitcoins — the first in , the second in February this year and the third last week. Do you have information about the Philippines? Should I just transfer it here in my German bank account and withdraw it or should I open a bank account in Switzerland its very close to me here across the border-I can even cross the border with walking without any border control! All of the banks are scared to hold FIAT gains made from Crypto, so it is hard to even cash out to your bank account if you have made significant gains. I also utilize a tax professional and pay the required taxes on all my crypto activity. Skip Navigation. Thank you very much for the information. Mail This Article. I am converting my amount to Bitcoins in Germany, to oppose the banking system, I transfer bitcoins to my wallet on one of the crypto exchange in India and get the money from exchange to my NRI Indian bank account. Great article. Portugal decided to join this group. Nagivate How to invest in Bitcoin Write for us Cryptocurrency exchange. Choose your reason below and click on the Report button. Niti Aayog's economic agenda for new govt likely to focus on boosting private investment: First, customers must create a complete view of all digital asset transactions.

- what hashrate does cpu meta mast or mist ethereum

- deposit bitcoin to wallet watch dogs bitcoin

- selling with coinbase in canada windows coinbase desktop widget

- what is the most private cryptocurrency putting money into a cryptocurrency wallet

- where can i get bitcoin cash get anonymous bitcoin wallet

- cryptonight cloud mining dogecoin cloud mine